Charitable giving not only helps those in need but can also provide financial benefits to the donor in the form of tax deductions. Understanding which donations are tax-deductible and how to claim these deductions can seem complex.

Discover through this article if all Charitable Contributions are tax deductible. Learn about different types of donations, from cash to stocks, and their tax benefits.

Charitable Contributions Deductions

Deducting charitable contributions allows donors to lower their taxable income by claiming the value of their donations to recognized nonprofit organizations, such as charities, educational institutions, and religious groups.

The Internal Revenue Service (IRS) specifies that these organizations must qualify under the 501(c)(3) designation or similar categories to be eligible for such deductions.

When donors make charitable contributions, they must maintain proper records like written acknowledgments for donations over $250 and receipts or bank statements for smaller amounts.

The amount that can be deducted from one’s income depends on the donor’s annual income and the nature of the donation; typically, it can be up to 60% of their adjusted gross income.

However, donations of certain items, like appreciated property or stocks, may have different rules and limits.

Are All Charitable Contributions Tax-Deductible?

Not all donations qualify for a tax deduction. For a donation to be tax-deductible, it must be made to an organization that is recognized by the IRS as a 501(c)(3) entity.

These entities include nonprofits, religious organizations, and educational institutions, among others.

Contributions made directly to individuals, political parties, or non-registered organizations are not eligible for tax deductions.

Understanding the status of the organization is crucial before making a donation if you wish to receive a tax benefit.

How much in charitable contributions are tax-deductible

The deductible number of charitable contributions can vary based on the donor’s adjusted gross income (AGI).

For cash contributions, you can deduct up to 60% of your AGI, while deductions for contributions of appreciated securities or other assets are typically limited to 30% of AGI.

Excess contributions can be carried forward for up to five subsequent tax years, which allows for strategic planning in high-income years.

When are charitable contributions tax deductible?

For a contribution to be deductible in the tax year, it must be made by December 31 of that year.

This includes checks mailed by the deadline (even if cashed after), and credit card charges made before the end of the year (even if the credit card bill is paid later).

Planning the timing of your donation can be crucial for maximizing tax benefits.

Types of charities to donate for tax deduction

When considering where to donate for a tax deduction, it’s important to choose organizations that not only align with your values but also qualify under IRS guidelines.

This includes a variety of entities such as educational institutions, humanitarian organizations, environmental groups, and health-related charities.

Ensuring that these organizations are registered as 501(c)(3) nonprofits is essential.

Are Donations to Foreign Charities Tax Deductible?

Generally, contributions to foreign organizations are not deductible on your U.S. tax returns.

There are exceptions for donations made through U.S. intermediary organizations that funnel donations to foreign charities while maintaining 501(c)(3) status.

If supporting international causes is important to you, consider donating through such intermediaries to ensure your contributions are deductible.

Tax-Deductible Charitable Contributions

The IRS allows deductions for various types of contributions to qualified entities, such as monetary gifts, securities, real estate, and other tangible goods.

The key is that these items must be donated to a 501(c)(3) organization and properly documented.

The deduction depends on the nature of the gift; for example, donated goods must be in good used condition or better to be deductible.

Cash Donation

Cash donations, while straightforward, require clear records such as bank statements or written acknowledgment from the charity detailing the donation amount, date, and charity’s information.

These are fully deductible up to the specified limits of your AGI, provided you have appropriate documentation.

How Much of a cash donation is tax deductible?

Cash donations to qualified charities can be deducted up to 60% of the donor’s AGI.

This allows for significant tax-saving opportunities, especially for those who can afford to make large donations.

However, it’s essential to keep meticulous records to substantiate these claims.

Donating Stock to a charity tax deduction

Donating appreciated stocks offers dual benefits: avoiding capital gains taxes that would be due if the stocks were sold and claiming a tax deduction for the full market value of the stocks at the time of donation.

.This makes it an attractive option for donors with appreciated securities

Tax Benefits of donating stock to charity

By donating stock that has appreciated in value, the donor bypasses capital gains taxes and potentially reduces their income taxes through the charitable deduction.

This strategy is particularly advantageous for stocks that have significantly increased in value since purchase

Gift to a Charity Tax Deduction

Gifts of tangible personal property, such as artwork or other valuable items, can be deducted at their fair market value if the charity uses the item in its operations.

If the item is auctioned or sold by the charity, the deduction may be limited to the cost basis rather than the market value.

Donate a Car

Donating a vehicle can be tax-deductible based on the car’s fair market value if the charity uses the vehicle for its programs.

If the charity sells the car, your deduction is limited to the sales price, and the charity must provide you with a receipt indicating this amount.

Donating Clothes to Tax Deductible

Donating clothes to organizations like Goodwill allows you to deduct the fair market value of these items, provided they are in good condition or better.

Detailed receipts and itemization of donated goods are required for these deductions.

Donating Property or Furniture

When donating property or furniture, the deduction is typically the fair market value of the items at the time of donation.

Large donations may require additional documentation, including appraisals, especially if the items are of significant value.

Blood Contribution

Although donating blood is a commendable and life-saving act, it does not qualify for a tax deduction because it does not have a quantifiable market value.

This expanded guide should provide a clearer understanding of how charitable contributions can both aid worthy causes and offer tax advantages.

Always consult a tax professional to navigate these options effectively, ensuring compliance with IRS regulations and maximizing your financial benefits.

Tax Credit for Donations

While most charitable donations result in a tax deduction, which lowers taxable income, some states offer tax credits for donations to certain types of charities, such

as those that provide educational scholarships or support for underserved populations.

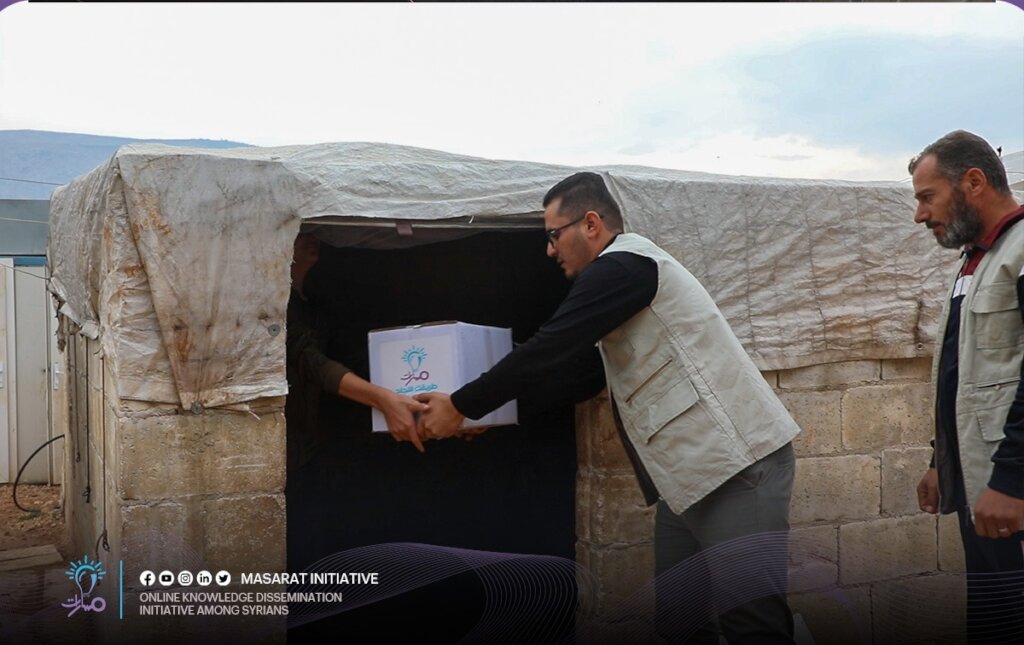

Masarat Initiative Partner of Global Giving with 501(c)(3) Tax-Exempt Status

Masarat initiative, in partnership with Global Giving and holding 501(c)(3) tax-exempt status, offers comprehensive educational services at no cost to Syrian students in need, particularly orphans, the underprivileged, and those with disabilities living in refugee camps. Masarat empowers individuals by providing them with essential tools to confidently join the workforce.

Since its founding, Masarat has aided over 31,000 beneficiaries. As a charitable organization, it partners with Global Giving, benefiting from 501(c)(3) tax exemptions in the U.S. and the U.K.

You can contribute to Masarat through donations, which are eligible for tax deductions. A confirmation email will be sent to facilitate tax documentation.

Join us in supporting Masarat, whether through financial contributions, expertise, or strategic partnerships.

Every donation, no matter the size, helps change students’ lives and paves the way for brighter futures for them and their communities.