In Islamic jurisprudence, specifically within the Maliki school, zakat al-mal is a fundamental and religious duty for Muslims. It involves specific conditions and rulings that determine the type of wealth subject to zakat, the obligatory zakat rate, and the social groups entitled to receive it.

Through this introduction, our article today will define the concept of zakat al-mal according to the Malikis, its conditions, rulings, the beneficiaries, and its role in balancing the economic status between the poor and the rich in the Islamic community.

The Merit of Zakat Al-Mal in the Maliki School

In Maliki jurisprudence, zakat is defined as a purification of wealth from impurities and a means for its growth and increase, based on the divine statement: “He has indeed succeeded who purifies it.”

Legally, zakat means discharging a specific part of wealth that has reached the nisab and has been held for a lunar year to its deserving recipients. For the Malikis, zakat is a fundamental pillar of Islam and a mandatory duty for every Muslim who meets the conditions of its obligation.

Conditions of Zakat Al-Mal According to the Maliki School

The conditions for zakat al-mal to be obligatory in the Maliki school include:

- Al-Mal reaching the nisab.

- Full ownership of the Al-Mal.

- Freedom, as zakat is not obligatory on slaves.

- Al-Mal having completed the lunar year, supported by the Prophet Muhammad’s saying: “No zakat is due on wealth until a year has passed.” However, zakat can be discharged about a month before the year completes if there is a need from the poor.

- Al-Mal must be free of debt that would reduce the nisab, unless the payer has other mal to settle it; except debts related to expiations for oaths, apparent separations, fasting, or required sacrifices in Hajj or Umrah, as these do not prevent the obligation of zakat.

When to Disburse Zakat Al-Mal?

Nisab of Zakat Al-Mal According to the Maliki School

The nisab for zakat al-mal in the Maliki school is set at the equivalent of twenty gold dinars or 85 grams of pure gold. Once the saved wealth reaches this amount, zakat becomes obligatory. The value is calculated based on the market price of a gram of gold, necessitating accuracy and honesty in estimating the nisab.

The evidence for this is what was narrated by Ali, may Allah be pleased with him, from the Prophet Muhammad: “If you own two hundred dirhams and a year passes, then five dirhams are due; and there is nothing due on you – in terms of gold – until you own twenty dinars, and when you own twenty dinars and a year passes, then half a dinar is due.”

Who Receives Zakat Al-Mal According to the Maliki School

Zakat is distributed to the eight categories mentioned in the Quranic verse: “Alms are for the poor and the needy, those employed to administer the funds, those whose hearts have been recently reconciled to truth, for those in bondage and in debt, in the cause of Allah, and for the wayfarer: Thus it is ordained by Allah, and Allah is full of knowledge and wisdom.”

1- The poor: Those who do not possess enough to sustain them for a year, even if they own a home.

2- The needy: Those who have no wealth or earnings and no one to support them. In the Maliki school, giving zakat to the poor and needy requires that they be Muslim and free.

3- Those Employed to Collect Zakat: These are individuals appointed to collect zakat funds. Zakat is given to them even if they are wealthy, as compensation for their work. The essential conditions for those employed in collecting zakat include:

- Fairness in collection and distribution.

- Knowledge of its rulings: ensuring no rights are neglected or funds withheld from the deserving.

4- Those whose hearts are to be reconciled: These are non-Muslims who are hoped to convert or new Muslims to strengthen their faith.

5- For freeing captives: A believing slave is bought with zakat funds and freed.

6- The debtor: A Muslim who owes debts that are due and must be paid.

7- In the cause of Allah: This refers to those engaged in jihad, with conditions including freedom, Islam, male gender, adulthood, ability, and not being from the Hashimite family.

8- The wayfarer: A traveler is given enough zakat to reach his destination.

How to Calculate Zakat Al-Mal According to the Maliki School

Zakat al-mal is calculated when a Muslim’s zakatable wealth reaches the nisab equivalent to 85 grams of gold or twenty dinars after a complete lunar year of possession.

To calculate the nisab value, the market price per gram of gold is multiplied by 85, and upon reaching this amount, zakat is due at a rate of 2.5% of the total amount.

Masarat to Sustainable Education and Training in Syria

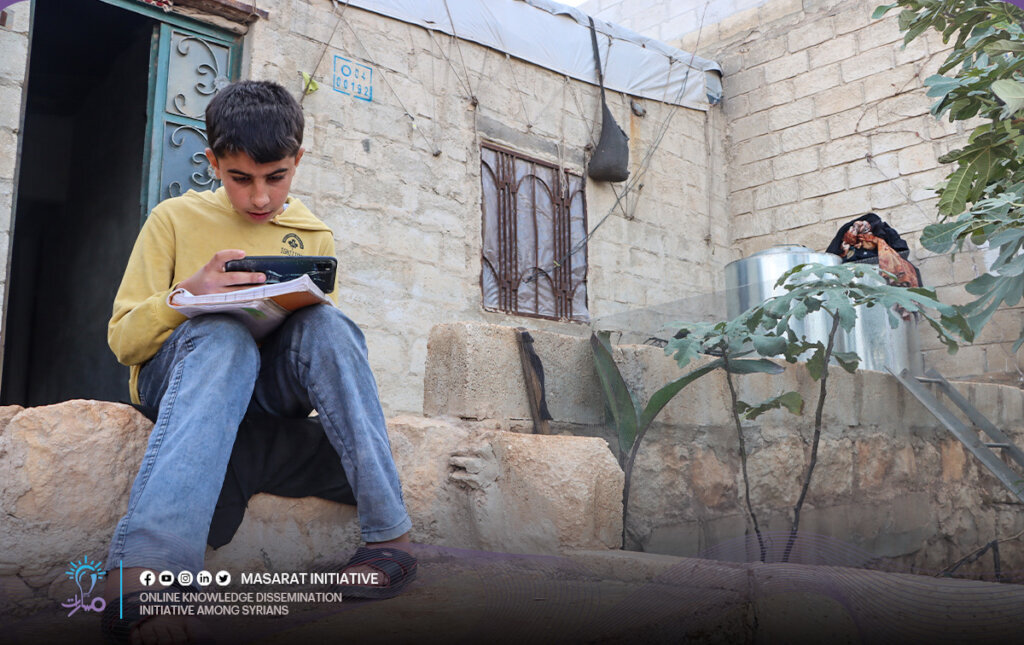

Thousands of students in northern Syria are cut off from education due to war, poverty, and displacement. The destruction of school infrastructure has left most students without the means to continue their education, forcing them into labor to support their families, potentially creating a generation without education.

Masarat Initiative provides free online education to these marginalized and out-of-school students using Microsoft Teams platforms. It offers them school education, student activities, academic advising, and supports them in building their futures independently of others or child labor.

Your donations will contribute to the continuity of online learning for these students, providing

opportunities for ongoing education for our children at home and in tents, free and comprehensively.