Zakat is a fundamental pillar of Islam, symbolizing the essence of social justice and charity. The Prophet Muhammad (peace be upon him) said, “The believer’s shade on the Day of Resurrection will be his charity” (Sahih al-Bukhari).

This article explores the purpose of Zakat al-mal, guidelines for its distribution in Canada, and the types of wealth subject to Zakat.

Learn where and how to pay Zakat in Canada. Understand the uses of Zakat money in Islam, distribution methods in Canada, and guidelines for different types of money.

What is Zakat Money Used for in Isalm?

In Islam, Zakat is an obligatory form of almsgiving aimed at redistributing wealth within the community to support those in need.

It helps alleviate poverty, supports those in debt, promotes Islamic causes, assists travelers in distress, and aids in freeing captives.

This charitable act purifies wealth and promotes social harmony and economic justice.

Where to Spend and Distribute Zakat Al-mal in Canada?

In Canada, Muslims have several options for distributing Zakat.

Local mosques and Islamic centers often facilitate the collection and distribution of Zakat to those in need within the community.

Charitable organizations like Islamic Relief Canada and the National Zakat Foundation are instrumental in managing and distributing Zakat funds effectively.

Additionally, individuals can directly assist eligible family members, neighbors, or other individuals in need.

How to Pay Zakat Al-Mal in Canada?

Paying Zakat Al-Mal in Canada involves calculating 2.5% of your qualifying wealth held for a lunar year.

This wealth includes money in bank accounts, savings, business investments, and other assets that meet the Nisab threshold.

Once calculated, you can distribute your Zakat through local mosques, recognized charities, or direct assistance to those in need.

Keeping documentation of your Zakat payments ensures accountability and compliance with Islamic principles.

On Which Money Zakat is Applicable

Zakat is applicable on various forms of wealth, including:

Money Held For a Year

Zakat is due on wealth that has been in your possession for one lunar year.

This ensures that the wealth is stable and has the potential to grow, making it eligible for redistribution.

Money Saved for House or Education or Hajj

Savings earmarked for significant life expenses, such as purchasing a house, education, or performing Hajj, are subject to Zakat if they meet the Nisab threshold

and have been held for a year. This ensures that even savings for personal goals contribute to societal welfare.

Money Owed

Debts that you expect to be repaid are considered part of your wealth for Zakat calculation. This includes loans given to others that are due for repayment within the Zakat year.

Money in a Bank in a Current Account

Balances in current and savings accounts are subject to Zakat if they meet the Nisab and have been held for a lunar year.

This includes money in both personal and business accounts.

Money saved or invested in business

Investments and savings in businesses are subject to Zakat.

This includes profits, inventory, and other business assets that meet the Nisab threshold and have been held for a year.

Money Saved Every Year

Regular savings that meet the Nisab and are held for a year are Zakatable. This encourages continuous charitable contributions from accumulated wealth.

Zakat Money to Sister

Zakat can be given to siblings if they fall under eligible categories, such as being poor or in debt.

This supports family members while fulfilling Zakat obligations.

Zakat Money Can Not Be Used in

Zakat cannot be used for personal expenses or to benefit oneself.

It is intended to assist the needy and must be distributed according to Islamic guidelines.

By understanding these guidelines, Muslims in Canada can fulfill their Zakat obligations in a manner that aligns with Islamic teachings and benefits the community.

Zakat On Haram Money

Wealth acquired through unlawful means is not purified by Zakat.

Such money should be disposed of in a manner that benefits the public welfare without the intention of gaining reward.

Zakat on Money Less than a Year

Wealth must be held for a full lunar year to be subject to Zakat. Money that has not completed this period is not eligible for Zakat.

Non-Muslims

While Zakat is primarily for Muslim recipients, non-Muslims can benefit from other forms of charity, such as Sadaqah.

Zakat is specifically designed to support the Muslim community, ensuring that those in need within the community are cared for.

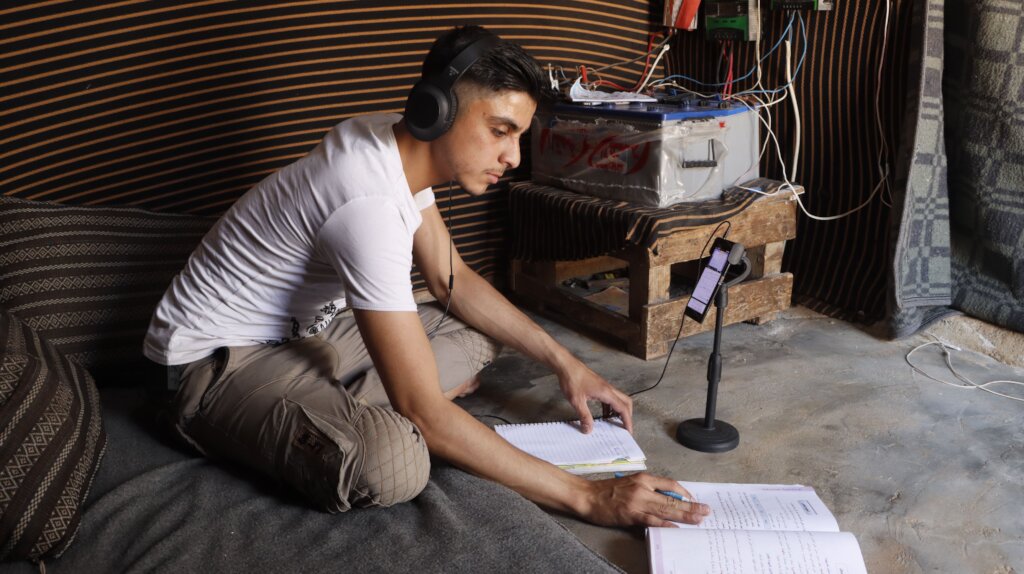

Masarat Initiative for Education and Youth Empowerment in Northern Syria

Driven by our humanitarian and community duties, Masarat Initiative was established to support children and youth in Northern Syria in the areas of education, care, and other related services.

Our entirely free initiative targets the most affected groups such as orphans, individuals with special needs, those who have been out of education for extended periods, and residents of displaced persons camps.

Masarat Initiative is distinguished by its openness to donations and humanitarian contributions.

Those who wish can contribute by donating their gold zakat to the initiative’s fund, providing support and aid to our children, potentially opening a door to a future that rescues them from their current suffering and deprivation.