Zakat al mal is a significant religious duty imposed to purify the soul and increase wealth, and it plays a vital role in strengthening the bonds and unity among Muslims, as essential as prayer, which is mentioned alongside it in the Quran.

This article will introduce you to an important aspect of zakat rulings—the distribution of zakat al mal to relatives and the related legal conditions. Is this distribution permissible, and what are the cases where it is obligatory?

Is It Permissible to Distribute Zakat Al Mal to Relatives?

Yes, Islam allows the distribution of zakat to needy relatives such as a poor brother, uncle, or maternal uncle, wherein the giver is rewarded doubly. This is based on the saying of the Prophet Muhammad, peace be upon him, “Charity to the poor is just charity, but to a relative, it counts as both charity and maintaining ties.”

Conditions for Distributing Zakat Al Mal to Relatives

Zakat al mal can be given to relatives under specific legal conditions:

- The relative should not be a direct descendant, such as children or their children.

- The relative should not be a direct ascendant, such as the mother or father.

- It is permissible to give zakat to other relatives like uncles, brothers, and cousins, provided they are among the poor or needy.

Methods of Zakat Al Mal for Relatives

Is it permissible to give zakat al mal to an impoverished brother?

Legally, it is permissible to disburse zakat al mal to a brother if he cannot meet his basic needs like food and housing, especially if he has no stable income source. Scholars emphasize that giving zakat to a brother is a priority if he is eligible within the eight accepted zakat categories.

Is it permissible to give zakat al mal to a married or single sister?

Regarding the permissibility of giving zakat to a sister, the law distinguishes between two situations:

- The single sister: It is permissible to give her zakat without any legal issue if she falls within the eight zakat categories.

- The married sister: It is not permissible to give her zakat if she receives sufficient maintenance from her husband. However, if her husband’s maintenance is insufficient due to his financial difficulties, then it is permissible to give her zakat to assist her.

Is it permissible to give all zakat al mal to brothers?

Certainly, this is permissible if they are among the categories that require zakat, as stated by Allah Almighty: “Alms are only for the poor and the needy, and those employed to administer the funds, and those whose hearts have been reconciled to truth, for those in bondage and in debt, in the cause of Allah, and for the wayfarer: a duty imposed by Allah. Allah is All-Knowing, Wise.”

Zakat Al Mal for the Family of a Deceased Brother

It is allowed to give zakat al mal to the poor and needy who lack an income source, provided their basic expenses are not the responsibility of the zakat payer himself. In such cases, financially supporting them from zakat is not permissible because the priority is to provide for them directly.

Is it permissible to give zakat al mal to a grandmother?

It is not permissible to give zakat al mal to a grandmother as she is considered a direct ascendant. Imam Shafi’i stated in Al-Umm: A man should not give zakat from his wealth to his father, mother, son, grandfather, grandmother, or anyone higher than them if they are poor, because their maintenance is obligatory on him and they are enriched by him.

Rulings on Zakat Al Mal for Parents

Is it permissible to give zakat al mal to parents?

It is not permissible to allocate zakat al mal specifically for parents or either of them, as a Muslim is legally obligated to cover their expenses from his own resources if they are in need.

Is it permissible to give all zakat al mal to parents?

Ibn Mundhir stated: Scholars unanimously agree that it is not permissible to give zakat to parents. Therefore, paying zakat al mal to parents is not permissible in Islam because they are direct ascendants, and the Muslim payer is obliged to provide for them, not give them zakat.

Cases Where It Is Permissible to Pay Zakat Al Mal to Parents

Sheikh Abdul Aziz Ibn Baz said: Paying zakat to relatives who are eligible is better than paying it to those who are not your relatives, as charity to a relative counts as both charity and maintaining ties.

Thus, it is permissible to give zakat al mal to parents only in two cases:

- If the son does not have sufficient funds to support his parents.

- To pay off the parents’ debts, as settling debts is not a direct obligation on the son.

Best Practices for Distributing Zakat Al Mal to Family and Relatives

It is permissible to give zakat to relatives and the needy, provided they are not from the giver’s direct ascendants or descendants, as their expenses are his obligatory responsibility.

Meanwhile, zakat can be given to brothers, sisters, cousins, maternal and paternal uncles, and aunts, as charity to them counts as both charity and maintaining ties. The Prophet Muhammad, peace be upon him, told Abu Talha, may Allah be pleased with him, regarding his charity: “I think you should put it among your relatives,” as reported by Bukhari.

Masarat to Vocational Training and Sustainable Education in Syria

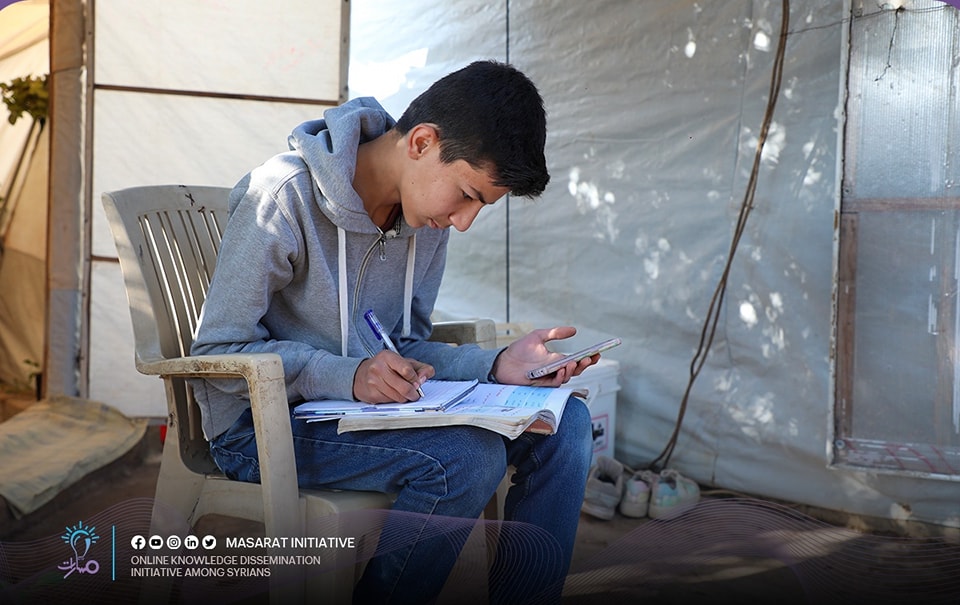

Thousands of students in northern Syria are cut off from education due to war, poverty, and displacement. The destruction of school infrastructure has left most students unable to continue their education, forcing them into labor to support their families, which threatens to create an entire generation without education.

Masarat Initiative provides free online education to these marginalized and out-of-school students using Microsoft Teams platforms. It offers them school education, student activities, academic advising, and supports them in building their futures independently of others or child labor.

Your donations will contribute to the continuity of online learning for these students, providing opportunities for ongoing education for our children at home and in tents, free and comprehensively.