Zakat al-Fitr stands as an Islamic pillar highlighting the values of mutual support and affection among Muslims, despite differing scholarly views on its payment method, whether in food items like grains or as monetary aid. This variance mirrors the flexibility of Sharia in easing the practice for Muslims and underscores the ultimate aim of Zakat, which is supporting the needy, thereby embodying the spiritual and social aspects of this worship.

This article aims to clarify the rulings and measures of Zakat al-Fitr, the circumstances under which it can be given in cash or in kind, and underscore its importance in fulfilling the needs of the poor and needy in the best possible ways.

Rulings on Paying Zakat al-Fitr in Grains

Is Zakat al-Fitr paid in money or grains?

It is narrated that Prophet Muhammad, peace be upon him, used to pay Zakat al-Fitr from dates or raisins by a measure of a Sa’, a practice agreed upon by Hanbali and Shafi’i jurists that the Zakat should come from the country’s staple food. However, Hanafis have allowed paying it in cash if it better serves the poor and needy.

Is it obligatory to give Zakat al-Fitr in grains?

It was stated that Prophet Muhammad, peace be upon him, specified Zakat al-Fitr as a Sa’ of dates, barley, or raisins, emphasizing it should come from the country’s staple food, while some scholars, like the Hanafis, permit its payment in cash if it better fulfills the need of the poor.

Is it permissible to give Zakat al-Fitr in cash instead of grains?

There is a disagreement among scholars regarding paying Zakat al-Fitr in cash or grains; some permit its payment in cash, others insist on grains, adhering to the Prophet’s practice of giving a Sa’ of dates or raisins. Some scholars advocate for cash payments to adequately meet the poor’s needs.

How much grain is due for Zakat al-Fitr how many kilos?

Zakat al-Fitr must be paid from grains like barley, dates, or rice, approximately 3 kilograms, based on the usual consumption of the people in the country, to be given before the Eid prayer.

How much does a Sa’ in Zakat al-Fitr weigh in kilos?

The Sharia-prescribed amount for Zakat is the prophetic Sa’, equivalent to four moderate handfuls, weighing about 2.175 kilograms according to Hanbali and Shafi’i schools, and 3 kilograms according to Hanafis, to ensure an excess that fulfills the obligation of purifying a Muslim’s duty.

Rulings on Exceeding the Specified Sa’ in Zakat al-Fitr

It is allowed to give more than the specified Sa’ for Zakat al-Fitr, considering the excess as charity rewarded, with an emphasis that the minimum is a Sa’ per individual and less is not acceptable.

Types of Grains for Zakat al-Fitr

Zakat al-Fitr from rice

Is it permissible to give out Zakat al-Fitr as rice?

is deemed among the best sustenances since it’s a primary food source for people, as are other seasons like dates and raisins.

What is the amount of Zakat al-Fitr from rice in kilograms per person?

The current measure for Zakat al-Fitr in rice is about 3 kilograms, equivalent to what can be held with fully extended hands four times moderately.

Fitr Zakat from Wheat Is

it permissible to give Fitr Zakat as wheat?

Fitr Zakat should be given from the staple food of the country’s population. Therefore, if wheat is part of their staple diet, it is permissible to give it as wheat or flour, as mentioned by Ibn Qudamah.

Amount of Fitr Zakat in Kilograms of Wheat

The amount of Fitr Zakat is estimated to be 3 kilograms of wheat according to current measures, while some believe that 2.6 kilograms is sufficient. It is preferred to give more to ensure fuller religious compliance.

Amount of Fitr Zakat in Flour

The ruling on giving Fitr Zakat as flour in Fitr Zakat

requires giving what is considered a staple food for the people. However, some schools of thought, such as the Maliki and Shafi’i, prohibit giving flour as Zakat, while the Hanafi school considers wheat or barley flour equivalent to their whole grain form.

How much Fitr Zakat should be given as flour in kilograms?

It is recommended to give Fitr Zakat as flour weighing 3 kilograms to compensate for the weight difference between flour and whole grains, emphasizing the importance of accuracy and precaution in this procedure.

How much Fitr Zakat should be given as flour?

The Fitr Zakat, when paid as flour, is estimated as a sa’ of wheat grains before grinding, considering the weight difference after milling. Therefore, precise weight measurement is crucial to ensure the correct amount is given.

Giving Fitr Zakat as Dates

Is it permissible to give Fitr Zakat as dates?

Giving Fitr Zakat as dates is allowed in line with the practices of the Prophet’s era, where it was given from primary foods such as dates, barley, raisins, and cheese. If dates are part of the people’s diet, it is permissible to give them as Fitr Zakat.

Amount of Fitr Zakat in Kilograms for Dates

The weight of Fitr Zakat in dates depends on the sa’ measurement and the type of dates used. Generally, the approximate weight for Fitr Zakat is estimated to be 3 kilograms of dates.

Paying Fitr Zakat through Ramadan Baskets for Students in Syria

It was narrated from the Prophet, peace and blessings be upon him, from Ibn Umar, may Allah be pleased with them, who said: “The Prophet of Allah peace be upon him made Zakat al-Fitr obligatory at the end of Ramadan, a sa’ of dates, or a sa’ of barley, on every slave and free man, male and female, young and old among the Muslims.” Narrated by Al-jamaa.

According to the teachings of the Prophet, it is preferred to give Fitr Zakat directly as food, which is supported by most jurists. However, to facilitate for Muslims in different regions, some have allowed giving it as cash. This permission has been extended to include giving Zakat in cash to charitable organizations and humanitarian institutions that focus on supporting those in need and the poor, especially in crisis areas like Syria and war-affected regions, providing them with the necessary financial and food support.

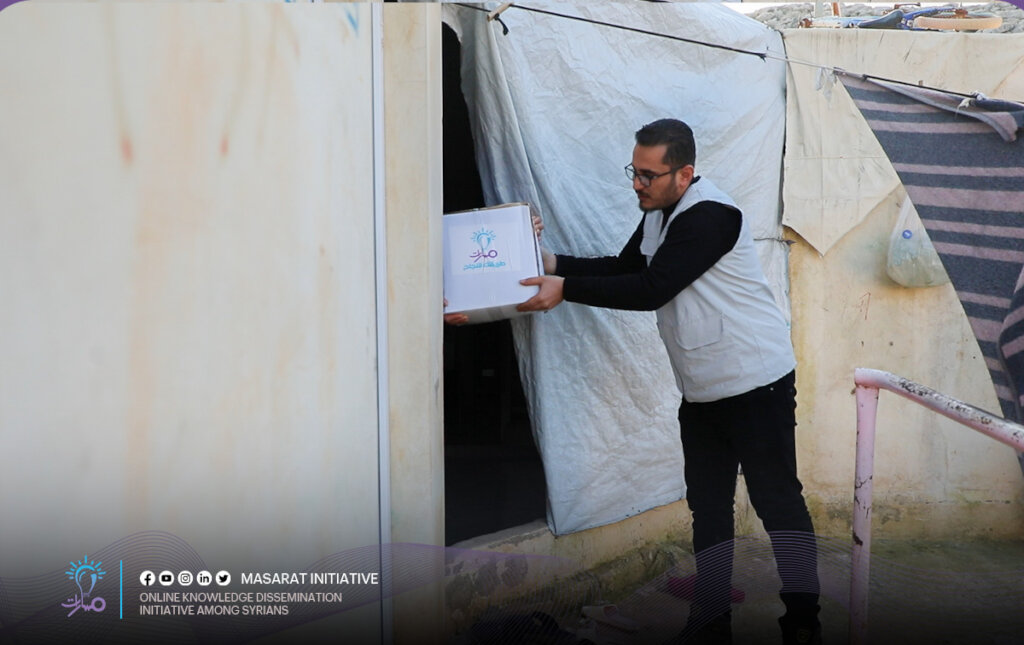

Masarat Initiative offers food baskets during the month of Ramadan to support students who are in dire need, such as orphans, individuals with disabilities, those with special needs, and the poor. These baskets include essential items like rice and sugar.

You can contribute to this initiative by paying your Fitr Zakat, where we ensure complete transparency in the distribution of aid and meeting the needs of students during this blessed month.

What are the Ramadan baskets for students in Syria?

In the face of the harsh humanitarian and economic conditions experienced by families in the displacement camps in northern Syria, Masarat works to provide food baskets to the families of students most in need, selected based on a study of each student’s data and an assessment of each family’s needs living in these camps, especially those affected by the February 2023 earthquake.

At Masarat, we invite you to donate your Zakat to provide these baskets that meet the needs of the poor and the needy, thereby doubling your reward in this life and the hereafter, as the Prophet, peace be upon him, said: “Whoever gives in charity the equivalent of a date from honest earnings, and Allah only accepts the good, Allah will take it in His right hand and nurture it for the owner, as one of you nurtures his foal, until it becomes like a mountain.”

The ruling on donating Fitr Zakat to youth and students in Syria

Fitr Zakat is obligatory for every capable Muslim, especially given the difficult situations faced by the people in northern Syria, where there is a dire need for support.

The Masarat initiative emerges as an opportunity to help thousands of students suffering from poverty. Scholars have permitted donating Fitr Zakat through charitable institutions that act as intermediaries to deliver this Zakat to its rightful recipients, which is considered a delegation in achieving this end.

How can you donate your Fitr Zakat through Ramadan baskets for students in Syria?

You can donate your Fitr Zakat to the neediest families in Syria by clicking on the following link. Masarat will convert the financial amounts into material goods according to the value of the paid Zakat and turn them into Ramadan baskets that reach their beneficiaries directly.

The campaign team at Masarat Initiative will document your Zakat and send it to you via your email if you wish.