Definition of Zakat:

Zakat is one of the five pillars of Islam. It’s a financial act of worship aimed at distributing wealth among members of the Muslim community. This distribution ensures economic balance, equity, and provides support to the needy and impoverished.

Types of Zakat:

Zakat on Wealth (Zakat Al-Mal): This involves paying a specific percentage of one’s wealth after a lunar year has passed.

Fitr Zakat (Zakat Al-Fitr): This is given at the end of the fasting month of Ramadan, before the Eid prayer.

Zakat on Agricultural Produce: This is due on crops and fruit harvests.

Zakat on Buried Treasure (Zakat Al-Rikaz): This pertains to treasure that is excavated from the earth.

How to Calculate Zakat on Wealth:

To compute your zakat, consider the following:

Nisab: This is the minimum threshold of wealth a Muslim must possess for zakat to be obligatory. Typically, the Nisab is calculated based on the weight of gold or silver.

The Passing of a Lunar Year: Zakat becomes obligatory after a full lunar year has passed over one’s wealth.

The zakat amount typically is 2.5% of the wealth retained over the lunar year.

Who are the Recipients of Zakat?

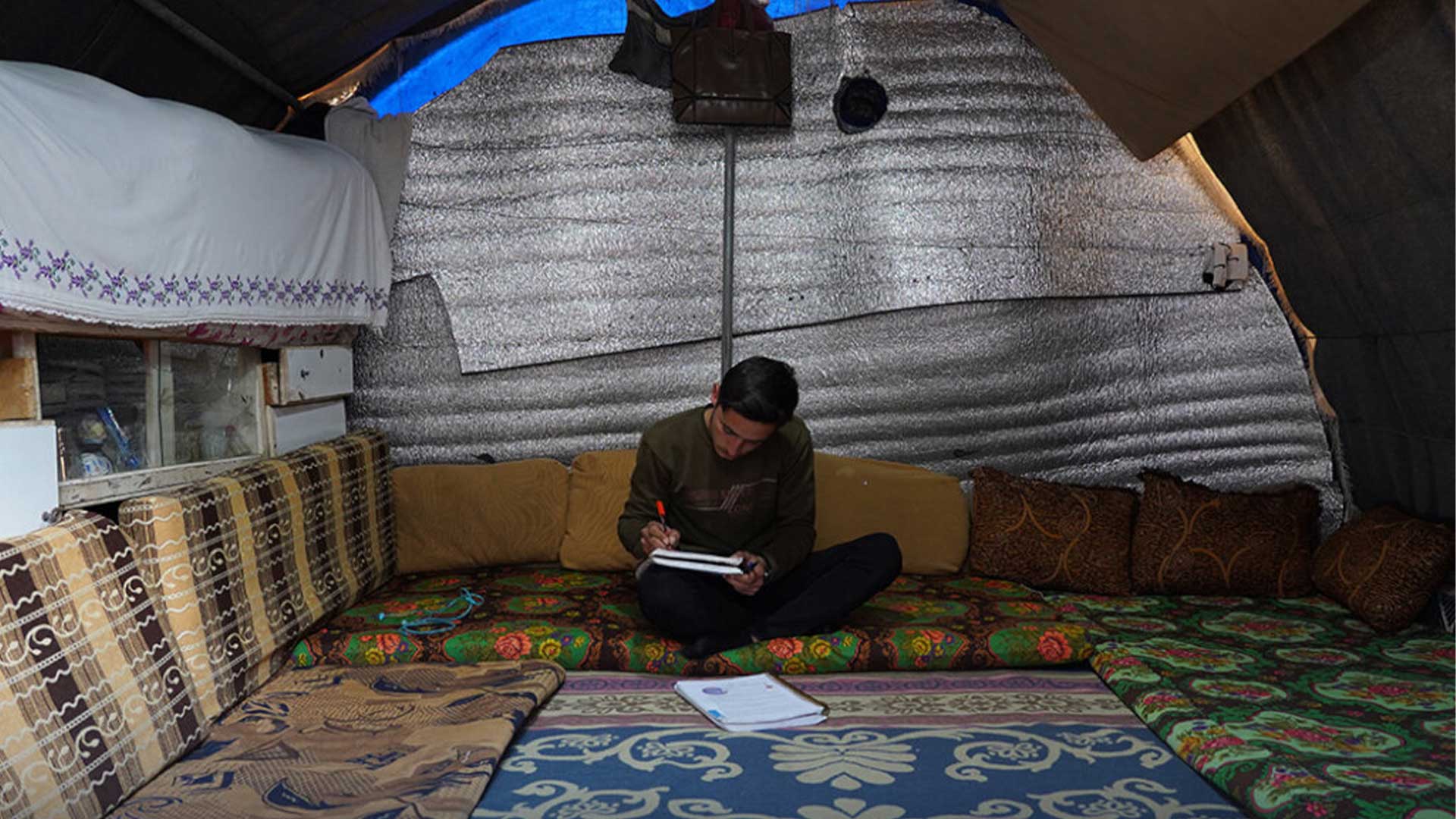

The Quran mentions in Surah At-Tawbah (9:60) the eight categories of people eligible to receive zakat. They are: the poor, the needy, zakat administrators, those whose hearts are to be reconciled, those in bondage, those in debt, in the cause of Allah, and the wayfarer.

In the context of allocating zakat for education, Sheikh Abdullah bin Baz has indicated in a fatwa the permissibility of this, especially considering prevailing circumstances and the pressing need to support education, especially for orphans and the poor.

In conclusion, zakat is a financial worship aiming to establish economic balance and assist those in need within the community.