In Islam, the concept of Zakat al-Mal is a fundamental pillar that reflects the faith’s emphasis on social justice, economic equity, and the purification of wealth.

The Prophet Muhammad (peace be upon him) said, “The best charity is that given by one who has little” (Sahih Bukhari). This article delves into the intricate details of Zakat al-Mal, exploring its rules, conditions, and significance in the Muslim community.

Discover the essentials of Zakat al-Mal in Canada , its rules, conditions, calculation, and differences from Zakat al-Fitr in Canada.

What is Zakat Al-mal?

Zakat al-Mal, often referred to as “almsgiving” or “sadaqah,” is one of the Five Pillars of Islam. It is a mandatory form of charity that involves giving a specific portion of one’s accumulated wealth to those in need.

This practice is intended to purify the donor’s wealth and soul, encourage social responsibility, and reduce economic disparities within the Muslim ummah (community).

Zakat Al-mal Rules

The rules governing Zakat al-Mal are derived from the Quran and Hadith, providing a clear framework for its calculation and distribution.

Key rules include the Nisab threshold, which is the minimum amount of wealth a Muslim must possess before they are liable to pay Zakat.

This threshold is equivalent to the value of 85 grams of gold or 595 grams of silver.

The wealth must be fully owned by the individual, free from any debts that exceed the Nisab, and held for a full lunar year.

Zakat is typically 2.5% of the total accumulated wealth above the Nisab.

Zakat Al-mal Conditions

For Zakat al-Mal to be obligatory, certain conditions must be met. The individual must be a Muslim, as Zakat is an Islamic duty, and must have reached puberty and be of sound mind.

The wealth must meet or exceed the Nisab threshold and have been in possession for a complete lunar year.

How Much is Zakat Al-mal?

The amount of Zakat al-Mal to be paid is 2.5% of the total wealth that exceeds the Nisab threshold.

For instance, if an individual’s wealth totals $10,000 and the Nisab is $1,000, then Zakat would be calculated as follows: ($10,000 – $1,000) × 2.5% = $225.

Types of Zakat Al-mal

Zakat al-Mal can be categorized into various types based on the source of wealth.

This includes cash, business assets, agricultural produce, precious metals and stones, and stocks and investments.

When Do You Pay Zakat Al-mal?

Zakat al-Mal is due after the wealth has been in possession for one full lunar year.

Many Muslims choose to pay Zakat during the month of Ramadan, as deeds performed during this holy month are believed to receive greater rewards.

Who Can Receive Zakat on Money?

Recipients of Zakat are specified in the Quran (Surah At-Tawbah, 9:60) and include the poor, the needy, Zakat collectors, new Muslims, those freeing captives, debtors, those in the path of Allah, and travelers in need.

Difference Between Zakat Al-mal and Zakat Al Fitr in Canada

While both forms of Zakat are obligatory, they serve different purposes and have distinct rules.

Zakat al-Mal is aimed at purifying wealth and aiding economic equity, calculated annually at 2.5% of an individual’s qualifying wealth.

Zakat al-Fitr is a fixed amount given by every Muslim at the end of Ramadan before the Eid al-Fitr prayer, aiming to purify those who fast from any indecent act or speech and to help the poor and needy.

In Canada, both forms of Zakat are practiced by the Muslim community, with local Islamic organizations providing guidance and assistance in calculating and distributing these charitable contributions.

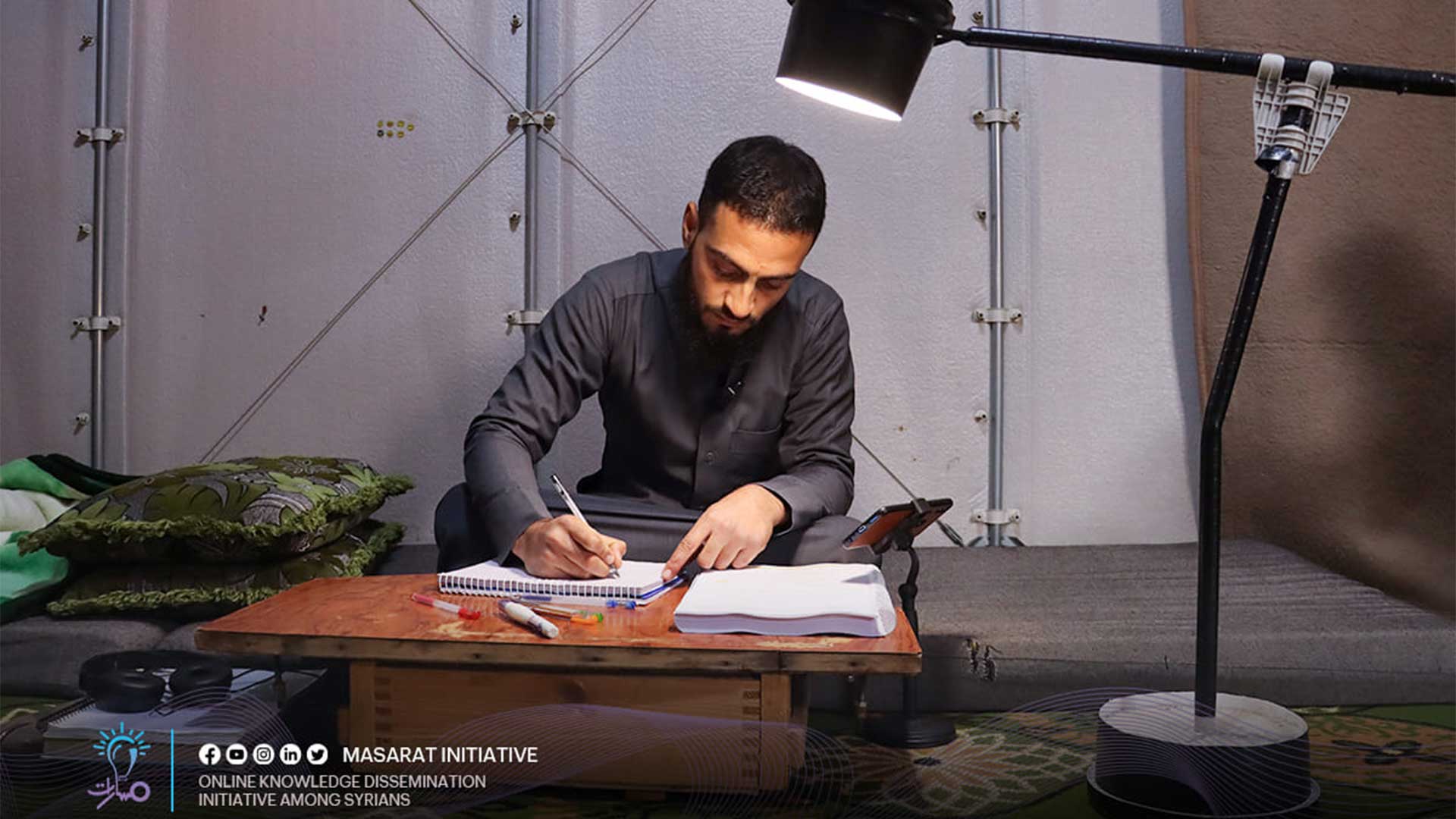

Masarat Initiative for Education and Youth Empowerment in Northern Syria

Refugee and internally displaced communities face challenging conditions that make accessing quality education highly challenging. The lack of essential resources presents a significant barrier to fulfilling their educational ambitions. Nevertheless, with sufficient support, we can contribute to changing this situation.

By donating your Zakat, you help illuminate the path of knowledge for refugee children, internally displaced persons, orphans, and individuals with special needs. Your contribution acts as a beacon of hope, opening the doors to the future for these children.

Your donation today represents a perpetual charity that endures for a lifetime, providing Masarat Initiative integrated knowledge services aimed at developing competent individuals in society by equipping them with educational tools, student activities, academic guidance, vocational training, psychological, and technical support.

These services aim to build the individual’s character and empower them within their community.

By donating today, you provide an opportunity to spread knowledge and education to those who need it most.