Zakat al-Mal is a fundamental pillar of Islam that ensures the equitable distribution of wealth and supports those in need.

In Indonesia, understanding the specifics of Zakat al-Mal, including when to pay and how to calculate it, is crucial for every Muslim.

This Article provides detailed insights into the conditions, types of wealth subject to Zakat, and the proper methods of calculation to help you fulfill this essential religious obligation.

Learn how to pay and calculate Zakat al-Mal in Indonesia, including the types of money subject to Zakat and detailed calculation methods.

What is Zakat Al-mal in Islam?

Zakat al-Mal, also known as Zakat on wealth, is one of the Five Pillars of Islam.

It is a mandatory form of almsgiving and religious tax that purifies one’s wealth by distributing a portion of it to those in need.

The primary purpose of Zakat is to help the less fortunate and ensure a fair distribution of wealth within the Muslim community

Ayat al Quran About Zakat Al-mal

The importance of Zakat is emphasized in several verses of the Quran. One such verse is:

“Take, [O, Muhammad], from their wealth a charity by which you purify them and cause them to increase, and invoke [Allah’s blessings] upon them. Indeed, your invocations are reassurance for them. And Allah is Hearing and Knowing.” (Surah At-Tawbah)

Types of Money for Zakat Al-mal in Indonesia

In Indonesia, various types of wealth are subject to Zakat. These include:

Zakat Total Money

This encompasses all cash and liquid assets held in hand or in bank accounts. If the total amount meets the Nisab threshold and has been held for a lunar year, Zakat is due on it.

Zakat Money Stolen

Money that has been stolen is not subject to Zakat as it is no longer in the possession of the owner. However, if the stolen money is recovered, Zakat becomes due if it meets the Nisab and Hawl conditions.

Zakat on Money Owed to You

Money that others owe you (loans you have given) is subject to Zakat if there is a strong expectation of repayment.

The Zakat on this amount should be calculated and paid when the money is received, assuming it meets the Nisab and has been due for a year.

When to Pay Zakat Al-mal?

Zakat al-Mal should be paid once a lunar year (Hawl) has passed since the wealth reached the Nisab threshold.

Muslims often choose to pay Zakat during the holy month of Ramadan due to its increased spiritual rewards, but it can be paid at any time of the year when due.

How to Calculate Zakat mal in Indonesia?

Calculating Zakat on money involves several steps:

Determine Total Wealth: Calculate all cash, bank balances, gold, silver, and investments.

Subtract Debts: Deduct any immediate debts and liabilities from the total wealth.

Ensure It Meets Nisab: Verify if the remaining amount meets or exceeds the Nisab.

Calculate Zakat: Multiply the total eligible wealth by 2.5% (the standard rate of Zakat on money).

What is The Rate of Zakat mal in Indonesia?

The rate of Zakat on money is 2.5%. This means that for every 100 units of currency, 2.5 units are given as Zakat.

Example in Indonesian Rupiah (IDR)

If you have 10,000,000 IDR:

- Zakat = 10,000,000 IDR * 2.5%

- Zakat = 250,000 IDR

Therefore, if your total eligible wealth is 10,000,000 IDR, you would need to pay 250,000 IDR as Zakat.

Nisab Zakat Mal

Nisab is the minimum amount of wealth one must possess before Zakat becomes obligatory.

The Nisab for Zakat al-Mal is equivalent to the value of 85 grams of gold or 595 grams of silver.

In Indonesia, the value of Nisab is calculated based on current market prices of gold or silver.

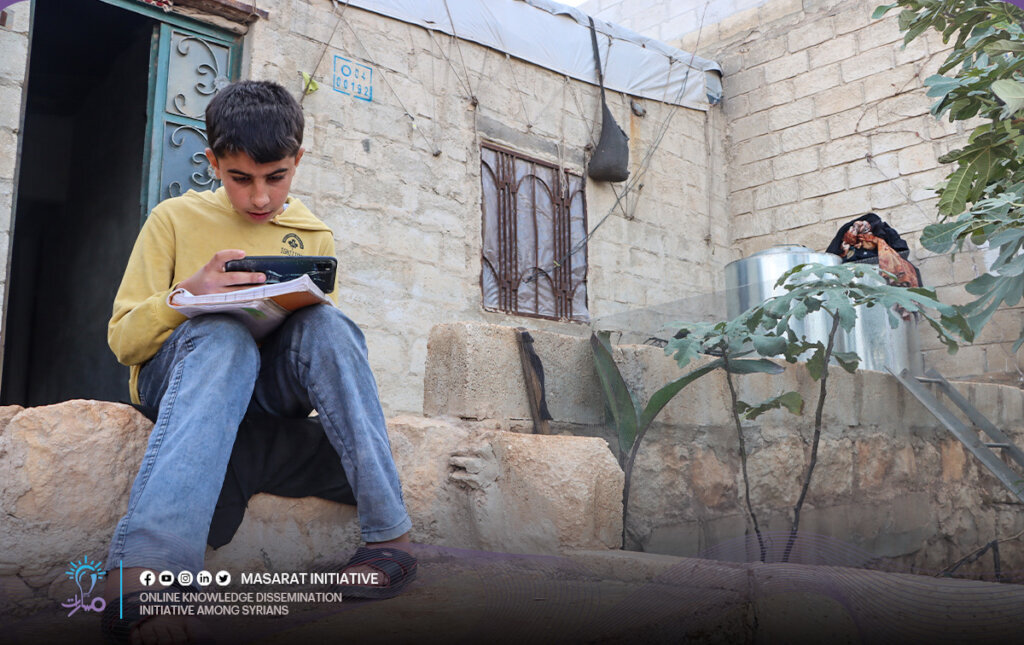

Masarat Initiative for Supporting Orphan Empowerment in Northern Syria

Due to the war in Syria, an entire community of orphans has been deprived of education for years because of forced migration, extreme poverty, and displacement. They have been forced to prioritize survival amid harsh living conditions. Nevertheless, hundreds of them still dream of returning to school.

The Masarat Initiative offers free online education to this segment of society through school education, student activities, and practical skills development via our easy-to-use online platform, ensuring comfort and flexibility.

By donating your Zakat, you will pave the way for the advancement and empowerment of orphans in society, equipping them educationally to be capable of building a better future. As orphans rise, an enlightened and aware community is formed, fostering a future built on awareness and knowledge.

Your contribution is not just an investment in the future of these orphans; it is an investment in a brighter and more equitable future for everyone.