In Islam, Zakat is a fundamental pillar and an act of worship that purifies wealth and ensures its fair distribution. Allah says: “Take from their wealth a charity by which you purify them and cause them to increase” (Surah At-Tawbah 9:103).

Zakat is a powerful tool for social reform and supporting those in need. One of the most impactful ways to use Zakat is by sponsoring students’ education, helping empower future generations and create lasting change in their communities.

This article explains how to calculate Zakat on Al-Mal, the importance of using it to support education by sponsoring students, and highlights the “Drop by Drop” campaign’s impact in Syria.

What is Zakat on Al-Mal?

Zakat on Al-Mal is a mandatory obligation on every Muslim who possesses wealth that reaches the Nisab (minimum threshold) and has been held for one lunar year (Hawl).

Zakat serves as a means to purify wealth, protect it from greed, and help redistribute it to balance the economic disparity between the rich and the poor.

The Drop by Drop campaign, launched by the Masarat Initiative, is an excellent example of how Zakat on Al-Mal can be used effectively and sustainably.

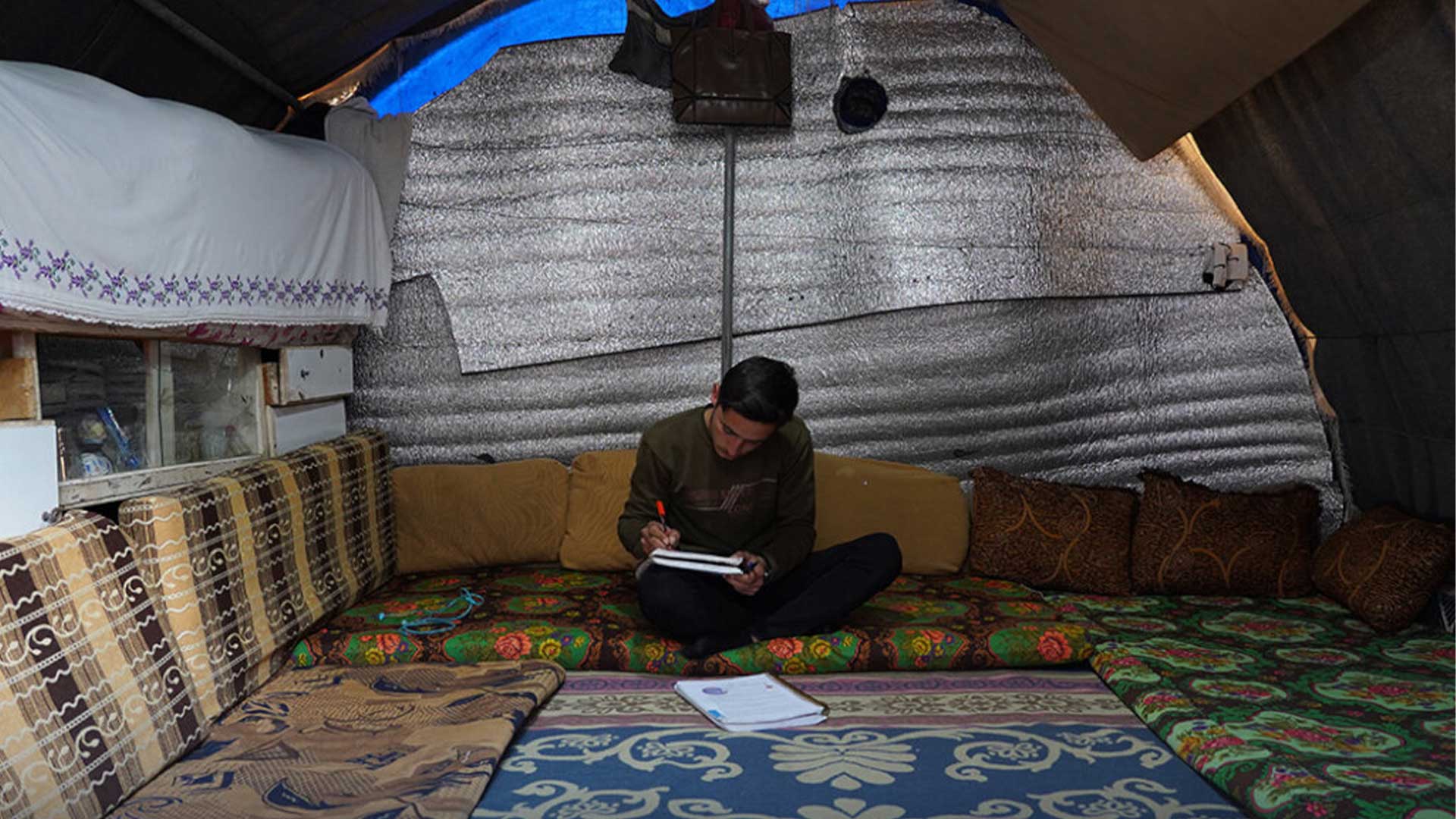

The campaign aims to support children in Syria, particularly those affected by conflict, by providing them with education and psychological support.

Through small donations, the campaign allows donors to change the lives of children and break the cycle of poverty. Donating to the Drop by Drop campaign is a real-life example of how Zakat can be used to enhance the lives of students and help build an educated, empowered generation.

The Importance of Zakat in Islam

Zakat is one of the fundamental pillars of Islam and a religious obligation that reflects the solidarity within the Muslim community. It is not merely a financial tax but an act of worship that fosters social responsibility and aims to achieve economic balance by reducing the gaps between different social classes.

Allah says in the Quran: “And establish prayer and give Zakat” (Surah Al-Baqarah 2:43). This verse, along with many others, highlights the immense importance of Zakat in Islam.

When a Muslim chooses to donate to sponsor a student through Zakat, they are not only improving the life of an individual but contributing to building a more knowledgeable and stronger community.

Types of Al-Mal Subject to Zakat

Several types of Al-Mal are subject to Zakat, including:

- Cash: Money held in bank accounts or as physical cash.

- Gold and Silver: Precious metals or jewelry made from them.

- Investments: Stocks, bonds, and other investment portfolios.

- Business Inventory: Goods held for sale.

- Agricultural Produce and Livestock: According to specific Islamic guidelines.

It is essential to ensure that these types of Al-Mal have reached the Nisab and have been held for one full lunar year before Zakat becomes due.

Directing Zakat on Al-Mal toward sponsoring students helps to support education and empower the next generation in underserved communities.

Conditions for Zakat on Wealth

Several key conditions must be met for Zakat on Al-Mal to become obligatory:

- Islam: Zakat is only required for Muslims.

- Nisab: The individual must possess wealth above the Nisab threshold.

- Full Ownership: The wealth must be fully owned by the individual.

- Hawl: The Al-Mal must be in the person’s possession for one full lunar year.

- Debt-Free: Any outstanding debts should be deducted before calculating Zakat.

Once these conditions are met, Zakat becomes obligatory. Donors can choose to allocate their Zakat on Al-Mal to support students in need, ensuring that education continues to play a vital role in improving the lives of individuals and communities.

What is the Nisab of Al-Mal?

The Nisab is the minimum amount of Al-Mal that a Muslim must possess before they are required to pay Zakat. The Nisab varies depending on the type of Al-Mal but is generally calculated based on the value of 85 grams of gold or its equivalent in silver.

To determine the Nisab, one must check the current market value of gold or silver.

When calculating Zakat on Al-Mal, it is essential to ensure that the Al-Mal has reached the Nisab and has remained with the individual for a full lunar year.

Directing Zakat on Al-Mal towards education and sponsoring students is one of the most effective ways to ensure that the money is used for long-term development projects.

When is Zakat on Wealth Obligatory?

Zakat on Al-Mal becomes obligatory when a Muslim possesses wealth that reaches the Nisab

Many Muslims prefer to pay their Zakat during the blessed month of Ramadan, as rewards are multiplied during this month. However, Zakat can be paid at any time of the year.

Donating to sponsor a student using Zakat on Al-Mal is one of the most effective acts one can perform to create a lasting impact.

How to Calculate Zakat on Al-Mal

Calculating Zakat on Al-Mal requires determining the total amount of wealth that is subject to Zakat, deducting any debts or liabilities, and applying the Zakat rate of 2.5%. Zakatable assets include cash, gold, silver, investments, business assets, and other valuables.

The basic formula for calculating Zakat is:

Zakat = (Total Zakatable Al-Mal – Liabilities) × 2.5%

Once you have calculated your Zakat, consider using your Zakat on Al-Mal to sponsor a student. Education is a long-term investment that yields benefits both for individuals and for the society as a whole.

Legitimate Uses of Zakat on Wealth

Islam specifies eight categories of Zakat recipients, as mentioned in the Quran, including the poor, the needy, and those in debt.

Among the legitimate uses of Zakat, donating to sponsor a student is one of the most impactful, as it provides students with the opportunity to continue their education and overcome financial challenges.

The Drop by Drop campaign is a prime example of how Zakat can be directed toward education. With small donations, even as little as $10 per month, donors can provide sustainable support to children affected by conflict in Syria.

The campaign highlights education as a way to break the cycle of poverty and ignorance, reflecting the ultimate purpose of Zakat in creating lasting, positive change.

How to Distribute Zakat on Wealth?

Zakat must be distributed according to Islamic law, which outlines eight categories of recipients mentioned in the Quran. These categories are:

- The Poor (Al-Fuqara): Individuals who lack sufficient resources to meet their basic needs.

- The Needy (Al-Masakeen): Those who possess some means but still do not have enough to sustain themselves.

- Those Employed to Collect Zakat: Individuals responsible for collecting and distributing Zakat.

- Those Whose Hearts Are to Be Reconciled: People who are given Zakat to strengthen their inclination towards Islam.

- Slaves Seeking Freedom (Ar-Riqaab): Those striving to free themselves from servitude.

- Those in Debt (Al-Gharimeen): Individuals burdened with debt and unable to repay it.

- In the Cause of Allah (Fi Sabeelillah): Those engaged in efforts that serve the cause of Islam, including education, charity, and other forms of communal benefit.

- Travelers in Need (Ibn As-Sabeel): Stranded travelers who require financial assistance.

Focusing on education, Zakat can be used to sponsor students who lack the financial means to continue their studies. Supporting students falls under the categories of the poor and needy, providing them with funds for educational expenses like tuition, books, and supplies.

This approach not only helps break the cycle of poverty for individuals but also empowers entire communities by building educated, capable generations.

Campaigns like “Drop by Drop” demonstrate how Zakat can be effectively directed towards education, contributing to sustainable growth and positive change in regions impacted by conflict.

Masarat for Sustainable Development and Education in Syria

Masarat Initiative is a non-profit organization dedicated to providing sustainable education and development opportunities for Syrian students, particularly those affected by conflict and displacement.

Masarat focuses on creating equal educational opportunities for vulnerable groups, including orphans, individuals with disabilities, and children living in camps.

Through the Drop by Drop campaign, launched by the initiative, donations are collected to support these children by providing education, psychological support, and essential skills to help them build a better future.

By utilizing innovative methods such as online education, Masarat ensures that students, regardless of their geographic location or financial status, have access to high-quality education. Through its various projects and campaigns,

Masarat aims to break the cycle of poverty by equipping Syrian youth with the skills and knowledge they need to build a better future. The impact of both the campaign and the initiative extends beyond education, fostering resilience, hope, and sustainable growth in a war-torn region.

Donate Now: Zakat for Masarat to Sponsor a Student

Masarat Initiative is dedicated to providing educational support to students in need, collecting Zakat on Al-Mal and using it to sponsor students who require financial assistance to continue their education.

The initiative plays a key role in offering sustainable education to children affected by conflict, such as through the Drop by Drop campaign, which provides an opportunity for the community to transform the lives of these children through small but meaningful donations.

Donate now to sponsor a student through the Masarat Initiative and invest in the future of students who need education to change their lives and achieve their dreams. By participating in these efforts, donors can make a lasting and positive impact on the lives of children and the broader community.