Zakat on crops and fruits plays a crucial role in the Islamic zakat system, reflecting the principles of social solidarity and justice. Understanding its rulings and differentiating it from other types of zakat, along with grasping the criteria determining the crops subject to zakat and the methods of its calculation, is essential for deepening awareness of zakat’s rulings and its contributions to supporting the deserving groups.

Ruling on Zakat for Crops and Fruits and Its Conditions

Zakat is imposed on agricultural outputs such as barley, wheat, grapes, and olives, according to Imam Abu Hanifa’s opinion. Its amount should be extracted from the fruits themselves, not their monetary value, at harvest time.

Is There Zakat on Agricultural Land?

Zakat is due on agricultural land designated for trade from its market value annually. However, if the land is prepared for farming, then its zakat is extracted from the crops that are subject to zakat.

The Difference Between Zakat on Crops and Fruits

Zakat on crops and fruits is imposed on what the earth produces of grains and fruits when the nisab is reached and at the time of harvest. The difference lies in the type of product and irrigation method; zakat on crops applies to grains like wheat and barley, while zakat on fruits applies to fruits like dates and grapes, with the zakat rate varying depending on irrigation and care methods used.

Types of Crops and Fruits Subject to Zakat

Scholars agree that zakat is obligatory on primary types of crops and fruits, including wheat, barley, dates, and raisins.

Conditions for Zakat on Crops and Fruits

Certainly, zakat on crops and fruits has necessary conditions for its obligation, among the most important are:

- The crops and fruits must be cultivated with human effort.

- The zakat payer must be Muslim.

- The produce reaches the nisab specified by the hadith “No zakat is due on less than five wasqs.”

- It must be among the types of grains and fruits that are measurable and storable.

Nisab for Zakat on Crops and Fruits

The zakat rate is set at a fixed measure based on the hadith of Prophet Muhammad PBUH conveyed by Abu Sa’id al-Khudri, may Allah be pleased with him, stating: “No zakat is due on less than five awaqs of silver, and no zakat is due on less than five camels, and no zakat is due on less than five wasqs.” This is equivalent to 653 kilograms of fruits or crops in our time.

How to Calculate Zakat on Crops and Fruits?

Zakat becomes obligatory on stored crops and fruits when they reach a specified nisab of five wasqs, equivalent to 653 kilograms. The amount of zakat varies based on the irrigation method; a tenth (10%) is applied to crops irrigated by rainwater, while half a tenth (5%) for those irrigated by machinery.

In the case of mixed irrigation methods, a tenth is extracted as a precaution, following the hadith: “For what is watered by the heavens and springs, or by rainfall, a tenth is due. And for what is watered by irrigation, half a tenth.”

The Prophet clarified that zakat is imposed when the fruit ripens and its edibility is apparent, like changing color to yellow or red. If the crop is sold before ripening, its zakat becomes the buyer’s responsibility.

Accounting for Irrigated Agricultural Crops

For each irrigation method, there’s a specific calculation:

- Zakat on crops irrigated naturally without cost, by rainwater or river water, is calculated at “a tenth,” meaning 10%.

- Crops irrigated through machinery or costly effort are estimated at “half a tenth,” meaning 5%.

- If irrigation methods are mixed between rainwater and specialized machinery, the zakat amount is “three-quarters of a tenth,” meaning 7.5%.

Are Expenses Deducted from Zakat on Crops?

Expenses and costs are not deducted from zakat on fruits and crops, as agreed by all four jurisprudential schools, supported by the Prophet’s saying, “half a tenth” for crops watered at expense, confirming the non-permissibility of deducting further costs without a legitimate reason.

Is It Permissible to Discharge Zakat on Crops in Cash?

It is religiously preferred to discharge the zakat of fruits in the same type rather than its monetary value. However, Ibn Taymiyyah points out exceptions allowing the discharge of value in cash for reasons of need, benefit, or justice, as in the case of selling fruit or crops for dirhams, where discharging a tenth of these dirhams suffices, exempting the zakat payer from purchasing fruit or wheat for the poor, thus ensuring equality and justice.

To Whom Are Zakat on Crops and Fruits Given, and Who Deserves It?

Zakat was ordained to meet the needs of the poor and ensure equality and justice among Muslims. Allah mentioned in His noble book the categories eligible for zakat, saying: (Charities are for the poor, the needy, those employed to collect [zakat], those whose hearts are to be reconciled, for slaves, for those in debt, in the cause of Allah, and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise) [At-Tawbah].

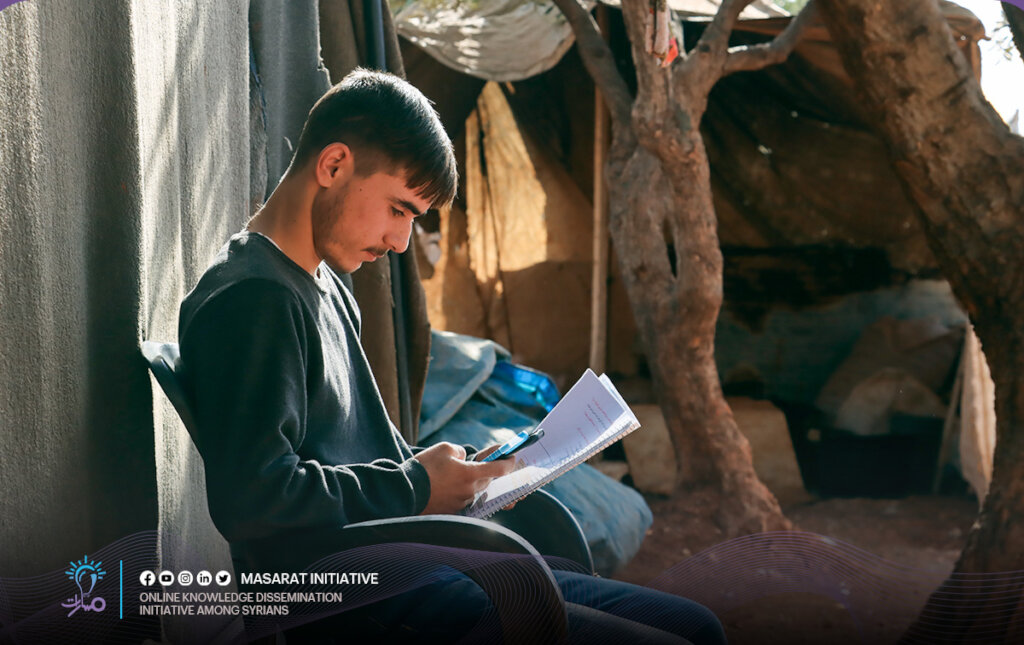

Masarat for Education and Vocational Training for Displaced People in Syria

Through the Masarat initiative, free online educational opportunities have been provided in recent years for those in Syria wishing to continue their education amidst the difficult circumstances caused by the war. This approach to distance education opens new horizons for students to overcome learning challenges, making your financial support for this initiative one of the best ways to help them achieve their academic goals.

Zakat on wheat was mandated to be extracted directly from the crop itself at the time of harvest in the era of the Prophet, as opposed to monetary zakat, which is calculated annually. This is based on the Quranic directive: “And give its due [zakat] on the day of its harvest.” Today, the Hanafi jurisprudence allows for zakat to be given either in cash or in a way that benefits the poor, adhering to the principle of meeting the poor’s needs and interests. According to the consensus of the four Sunni Islamic schools of jurisprudence, zakat on agricultural produce is due at the time of harvest, without the need to deduct any production costs. However, some scholars permit deducting production costs for farmers in cases of necessity, such as poverty or debt, emphasizing that the default ruling does not allow for such deductions, but Allah facilitates for farmers by reducing the zakat rate from a tenth to half a tenth for crops that require costly irrigation. Vegetables and fruits that are not stored or weighed, such as watermelons, are not subject to zakat unless they are intended for trade. In such cases, their value is zakatable annually once it reaches the nisab, similar to other trade goods. It is preferred to distribute zakat among the poor and needy of one’s own country. However, it is permissible to transfer it to another country for legitimate reasons, such as supporting mujahideen, deserving relatives, or students of Islamic knowledge. Based on the verse “And give its due [zakat] on the day of its harvest,” zakat on fruits and crops is calculated at the time of harvest without waiting for the completion of a lunar year. This includes zakat on olive trees, regardless of whether they are irrigated or rain-fed. According to the Hanafi school, zakat is mandatory on crops and fruits that are not edible when the produce reaches a nisab of 612 kilograms. Ibn Uthaymeen stated that zakat on grains and fruits should be given from the same type of grains and fruits. However, if there is a need or benefit in giving it in cash, it is permissible. Allah has specified eight categories eligible for zakat, including relatives, provided they are not the zakat payer’s immediate dependents, such as parents or children. Giving zakat to relatives within these categories is valid and encouraged if they are in need. For partners in an agricultural product, each is treated as an individual concerning zakat. If an individual’s share does not reach the nisab after division, zakat is not due. However, if it does, zakat must be paid, by consensus of most scholars. Advancing zakat is permissible under certain conditions, such as having the nisab and intending the advance for one year only without exceeding it. The beneficiary of the advanced zakat must also be eligible at the time the zakat becomes due. When giving zakat to the eligible poor and needy as mentioned in the Quran, there is no need to specify that the funds are zakat. This approach is supported by the Maliki, Hanbali, and Shafi’i schools, which prefer not to disclose the nature of these funds as zakat. Delaying the discharge of zakat on crops is not permissible, based on the directive: “And give its due [zakat] on the day of its harvest.” However, delaying for a legitimate reason is allowed. Giving zakat to a brother is permissible because siblings are not among the immediate dependents whom one is obligated to support financially, unlike parents, spouses, and children. Zakat is only obligatory on land designated for trade. Land intended for building a home does not attract zakat. Agricultural land’s zakat is derived from its produce, whether crops or fruits.Frequently Asked Questions about Zakat on Crops and Fruits

Is it necessary to extract the zakat for wheat from the grains themselves?

Is zakat on crops due before or after accounting for production costs?

Is there zakat on vegetable farming?

What is the ruling on transferring zakat on crops and fruits to another country?

What is the time of obligation for discharging zakat on crops and fruits?

Is there zakat on non-edible crops?

Is it permissible to discharge zakat on crops in cash according to Ibn Uthaymeen?

Is it permissible to give zakat on crops to relatives?

Should partners in cultivation pay zakat before or after division?

Is it permissible to advance the discharge of zakat on cultivation before harvest?

Is it permissible to pay zakat without specifying it as zakat?

Is it permissible to delay the discharge of zakat on crops?

Is it permissible to give zakat on crops to a brother?

Is there zakat on uncultivated land?