Zakat al-Fitr is one of the foundational acts of worship in Islam, obligatory for every capable Muslim. It serves to purify the soul and wealth and is a religious means of strengthening the bonds of love and social solidarity in the Muslim community.

This article addresses key inquiries regarding the legitimacy of Zakat al-Fitr in a Country Other, its Sharia ruling, and the main regulations concerning sending zakat abroad, concluding with answers to common questions about this significant religious issue.

Is Zakat al-Fitr Required to be Disbursed in the Country of Residence?

Islam mandates Zakat al-Fitr for every free Muslim; adult or child; and the fundamental practice is for the payer to disburse it in their country of residence to fulfill its purpose of purifying the fasting individual and enriching the poor in their vicinity. This reflects the principle of social solidarity in Islam. Ibn Qudamah stated, “As for Zakat al-Fitr, it should be disbursed in the country where it becomes obligatory on him, regardless of whether his wealth is there or not.”

The Ruling on Disbursing Zakat al-Fitr in Another Country

An exception to this principle is if there is a greater need or necessity elsewhere, such as in the event of natural disasters or extreme poverty in another country. In such cases, disbursement of zakat to that place is considered permissible and preferable to aid those in need there. The evidence for this is that the Prophet Muhammad would call for charities to be brought to Medina and distribute them among the deserving.

Is It Permissible to Disburse Zakat al-Fitr in a Country Other Than the Payer’s?

Therefore, disbursing Zakat al-Fitr in a country other than the payer’s is permissible in Islam based on the perceived need and necessity, considering factors such as the original purpose of zakat, necessity, and the payer’s intention.

The principle is to pay Zakat al-Fitr in the same country of the Muslim’s residence, and it should not be transferred unless there are no eligible zakat recipients in the same country, or there is someone in more need in another country, particularly if they are relatives; it is permissible to send zakat to them.

Ibn Taymiyyah commented, “The predecessors said: The neighbors of the wealth are more entitled to its zakat, and they disliked transferring zakat to the ruler’s country or elsewhere; so that each area could be self-sufficient with the zakat it has, and transferring zakat and what is similar to it for a legitimate benefit is permissible.”

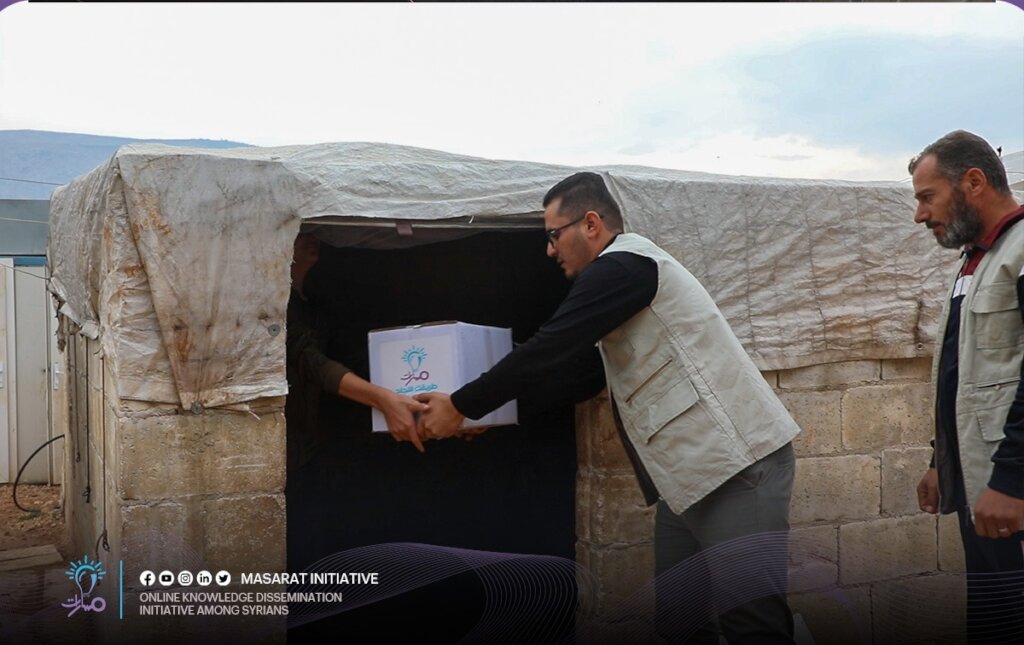

Donating Zakat al-Fitr Online to Syrian Camps

Scholars permit paying Zakat al-Fitr to charitable organizations and associations concerned with Syrian issues, aiming to improve their living conditions with minimal resources amidst the harsh conditions Syrians face in camps, and the daily challenges of life deprivation and economic hardships.

Sheikh Ja’far Ahmad al-Talhawi stated, “It is permissible to transfer the monetary value of Zakat al-Fitr to its rightful recipients in any country, through charitable institutions or even individuals, provided this method is reliable.”

Masarat Initiative for Supporting and Empowering Syrian Youth

The Masarat Initiative offers free education and all means of knowledge and learning to all community sectors, especially those most affected. We see education as the sole path to changing the lives of many in need of such opportunities.

Our initiative is a charitable organization registered in Turkey; so far, we have helped nearly 30,000 students affiliated with it.

Your Zakat al-Fitr donation will support needy students affiliated with the Masarat Initiative, ensuring your zakat reaches its rightful recipients, with your support documented and sent to you via email.