Zakat al-Fitr is an act of worship performed by Muslims at the end of the month of Ramadan; it serves as purification for the person from idle talk and obscenities, as mentioned by the Prophet, reminding the fasting individual of their brothers in need.

In today’s article, we shine a light on Zakat al-Fitr in extensive detail covering its various aspects, rulings on eligibility and disbursement, and answer the most common questions about it.

Is it permissible to give Zakat al-Fitr to charitable organizations?

In Islamic jurisprudence, giving Zakat to charitable organizations is permissible and is a form of authorized delegation in Islam.

It is required that the financial manager of the charity disburse the Zakat according to its Sharia-compliant uses.

Is it permissible to give Zakat al-Fitr to a student of knowledge?

Islam permits giving Zakat al-Fitr to a student of knowledge, considering them among the poor who are eligible for Zakat in Islam due to their endeavor in seeking knowledge.

Information about Zakat al-Fitr

Is Zakat al-Fitr obligatory or Sunnah?

Zakat al-Fitr is an obligatory act upon every Muslim by consensus among the four schools of thought, with the Prophet’s saying: “The Prophet peace be upon him ordained Zakat al-Fitr as one sa’ of dates or one sa’ of barley on every Muslim, young and old, male and female, free and slave, and ordered that it be paid before people go out for [Eid] prayer.” Al-Shinqiti mentioned that the term “ordained” in the Prophet’s saying indicates obligation and necessity; because a Faridah (obligatory act) is deemed necessary, leaving no choice for the obligated individual to omit it.

The Merit of Disbursing Zakat al-Fitr

1- Helps the poor secure their food needs during Eid days.

2- Acts as purification for the fasting individual from idle talk and obscenities encountered during Ramadan, thus completing any deficiencies in the Muslim’s fasting.

3- Increases communication among members of the Ummah and brings joy and happiness to a needy Muslim on the first day of Eid.

4- Zakat al-Fitr is obligatory and its disbursement is among the righteous deeds performed by a Muslim to draw closer to Allah.

Conditions for the Obligation of Zakat al-Fitr

Islam has made Zakat al-Fitr obligatory and a pillar of Islam; attaching it to three primary conditions:

- Being Muslim: Zakat al-Fitr is obligatory only on Muslims to purify their fasting.

- Financial Ability: The provider must possess enough sustenance for themselves and their household for one day and night.

- A Specific Time: Zakat al-Fitr is to be given out only at a specified time; after the sunset of the last day of Ramadan.

When Was Zakat al-Fitr Instituted?

Zakat al-Fitr was prescribed for Muslims in the second year of Hijra, the same year Allah commanded the fasting of Ramadan; to serve as purification for the Muslim’s soul.

When To Pay Zakat Al-fiter ?

Zakat al-Fitr is an obligatory charity for every Muslim, to be paid before the end of Ramadan and before the Eid al-Fitr prayer. It should be given as soon as the sun sets on the last day of Ramadan, and it is preferable to pay it before performing the Eid prayer.

The purpose of Zakat al-Fitr is to purify the fasting person from any idle or inappropriate speech that may have occurred during the fast, and also to bring joy and happiness to the poor and needy on the day of Eid.

Zakat al-Fitr is typically measured as a sa’a (a specific measure) of staple food such as wheat, barley, dates, or rice, and in some schools of thought, it can be paid in monetary value. Delaying the payment of Zakat al-Fitr until after the Eid prayer without a valid reason is considered a neglect of this religious duty.

Therefore, Muslims are strongly encouraged to pay it on time as part of the acts of worship that complete the observance of Ramadan.

The Difference Between Zakat al-Mal and Zakat al-Fitr?

Islam has made Zakat an obligation upon Muslims, with differences in its type and nomenclature. Understanding these differences is essential. This section elucidates the distinctions between Zakat al-Fitr and Zakat al-Mal.

The Reason

- Zakat al-Mal: Imposed on wealth and possessions owned by a Muslim according to a specified Nisab (minimum amount).

- Zakat al-Fitr: Imposed on individuals or families as a purification of the body, not wealth, specifically at the end of Ramadan. There is no Nisab for it.

Eligible Recipients

- Zakat al-Fitr: Directed only towards the poor and needy.

- Zakat al-Mal: is obligatory for eight categories mentioned by Allah Almighty in the noble verse: “Charities are only for the poor, the needy, those employed to collect them, to attract the hearts of those who have been inclined [towards Islam], for slaves, for those in debt, in the cause of Allah, and for the wayfarer; [it is] an obligation imposed by Allah. And Allah is Knowing, Wise.”.

Timing of Disbursement

- Zakat al-Mal: Due on wealth or possessions after completing one lunar year.

- Zakat al-Fitr: Due at the end of Ramadan, one or two days before Eid prayer.

Amount of Zakat

- Zakat al-Mal: 2.5% is given on wealth and possessions reaching the Nisab.

- Zakat al-Fitr: Estimated by giving out one sa’ of the local staple food, like a sa’ of dates or grains.

Zakat al-Fitr and Voluntary Sadaqah

Obligation

Zakat al-Fitr is obligatory for every Muslim at the end of Ramadan, while voluntary charity is optional and not obligatory.

Timing of Disbursement

Zakat al-Fitr is paid at the end of Ramadan or before the Eid prayer, while voluntary charity can be given at any time of the year.

Amount

The amount of Zakat al-Fitr is specified as one sa’ per individual, whereas the amount of voluntary charity can be determined according to the donor’s capacity and desire.

Eligible Recipients

Zakat al-Fitr is specifically given to the poor and needy on the night of Eid, while voluntary charity is given for any charitable act performed by a Muslim.

Who is Obligated to Pay Zakat al-Fitr?

Zakat al-Fitr is obligatory on every Muslim, regardless of age, even for an unborn child if born alive on the night of Eid, thus it is obligatory on both males and females alike, and on both the free and the slave. It is a duty prescribed at the end of Ramadan, and every Muslim must discharge it for themselves and their family.

To Whom is Zakat al-Fitr Given?

Zakat al-Fitr is given to the poor, needy, and those who do not have enough to sustain themselves on the day of Eid, as the Prophet Muhammad said, “Enrich them on this day.”

The Ruling on Disbursing Zakat al-Fitr in Cash

The original practice of giving out Zakat al-Fitr is in the form of food according to the Shafi’i, Maliki, and Hanbali schools of thought, based on Ibn Umar’s narration: “The Prophet of Allah peace be upon him ordained Zakat al-Fitr from Ramadan as one sa’ of dates or one sa’ of barley upon the slave and the free, the male and the female, and the young and the old among the Muslims.”

However, some Hanafis permit disbursement of Zakat al-Fitr in cash if it serves the need of the poor better, or for Muslims in European countries for ease.

Is it Permissible to Disburse Zakat al-Fitr in Cash?

In Islamic shariea, the majority of the jurisprudential schools agree on disbursing Zakat al-Fitr in the form of food as ordained by the Prophet and as narrated from the Companions; because the primary purpose of Zakat al-Fitr is to bring joy to the poor and needy and prevent them from needing to ask for help.

But some scholars have issued fatwas allowing Zakat al-Fitr to be given in cash if it serves the interest of the poor and needy better and fulfills the purpose of its disbursement.

Who has disbursed Zakat al-Fitr in cash?

It has been mentioned that Umar ibn al-Khattab, his son Abdullah ibn Umar, Abdullah ibn Mas’ud, Abdullah ibn Abbas, and Muadh ibn Jabal were among those who said that Zakat al-Fitr could be given in cash, and this view was agreed upon by jurists of the schools, including Abu Hanifa al-Nu’man and his followers, Ahmad ibn Hanbal, and Imam Bukhari.

Benefits of the Legitimacy of Zakat al-Fitr on Society and the Poor

The virtues of Zakat al-Fitr for both the giver and the recipient are manifold:

- It serves as purification for the fasting individual from idle talk and obscenities during fasting.

- It prevents the poor from needing to ask for help on this day.

- It is a Zakat on the self and body; by paying it, one seeks the face of Allah and His satisfaction.

- Paying it at the prescribed time brings a great reward from Allah for bringing joy to needy Muslims.

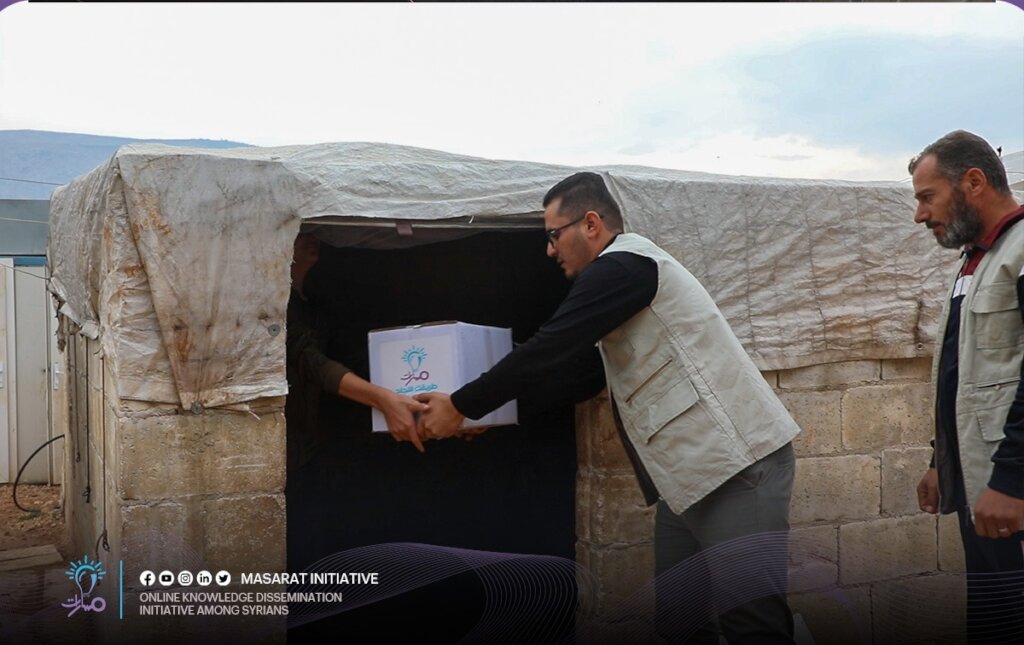

Masarat for Education and Knowledge Dissemination Remotely in Syria

In refugee camps and amid life’s hardships, orphaned children dream of studying—a dream not so difficult. Masarat faces the challenges and difficulties of education in Northern Syria, providing free education and facilitating access to knowledge through an interactive online environment and non-interactive lessons via a Learning Management System (LMS), along with a knowledge endowment specifically for the Masarat initiative on YouTube.

Masarat strongly believes in the power of education and its role in building more stable communities. The primary goal of Masarat is to expand the beneficiary base to make education a fundamental part of their lives.

You can also support and assist these children by delivering your donations to them through the Masarat initiative, which documents every amount you send.

Your Zakat al-Fitr donation reaches orphaned children, those in need of this money, achieving thus a great deal of goodness and truth before Allah, as He Almighty says: “Who is it that would loan Allah a goodly loan so He may multiply it for him many times over? And it is Allah who withholds and grants abundance, and to Him, you will be returned,” showing that your donation to children and youth is the ultimate good you can offer them.

These orphans need educational opportunities and empowerment in the absence of their providers to become positive and effective members of society.