The act of giving charity is deeply embedded in Islamic teachings, serving as a means to purify wealth and help those in need.The Prophet Muhammad (Peace be upon him) emphasized this in a hadith recorded in Sahih Muslim: “Charity does not decrease wealth.”

This profound statement encourages Muslims to engage in charitable acts, assuring them that their wealth will not diminish but instead be

blessed and purified. For Muslims living in Canada, calculating Zakat in Canadian dollars (CAD) is essential to fulfilling this religious obligation accurately.

Learn how to calculate Zakat in Canada in CAD, covering nisab, percentage, and detailed asset calculations. Discover the intricacies of Zakat on different wealth types.

Zakat in Islam

Zakat, the third pillar of Islam, is not just a voluntary act of kindness but a mandatory form of charity required from every eligible Muslim.

It serves as a mechanism to redistribute wealth within the Muslim community, ensuring that those in need receive support.

Zakat is a means to purify one’s wealth by allocating a portion of it to the less fortunate.

Nisab, Percentage & Rules

Zakat is obligatory only for Muslims whose wealth exceeds a certain threshold, known as the Nisab. The Nisab is the minimum amount of wealth a Muslim must possess before Zakat becomes obligatory.

According to Islamic jurisprudence, the Nisab is traditionally set as the equivalent of 87.48 grams of gold or 612.36 grams of silver. When calculating Zakat in Canada, it’s crucial to convert these values into Canadian dollars using the current market prices for gold and silver.

The standard Zakat rate is 2.5% of the total wealth that meets or exceeds the Nisab and is held for at least one lunar year. This means that Zakat is due only on wealth that has been in your possession for a full lunar year and is above the Nisab threshold. Additionally, Zakat is calculated annually, ensuring that the wealth is purified regularly in accordance with Islamic rules.

Calculating Zakat in Canadian Dollar per Money Type

Calculating Zakat on various forms of wealth requires specific steps to ensure accuracy, particularly when converting values to Canadian dollars.

All calculations should be converted to Canadian dollars using current exchange rates. To ensure compliance with Islamic principles and Canadian financial regulations, it is advisable to consult a financial advisor with expertise in Islamic finance.

Below is a streamlined guide on how to calculate Zakat for different asset types in Canada.

Zakat on Gold

Gold is a key asset in Zakat calculations. To calculate Zakat on gold in CAD:

- Determine the total weight of your gold holdings.

- Find the current market price per gram in Canadian dollars.

- Multiply the total weight by the market price to get the value.

- Apply the 2.5% Zakat rate to this value.

Zakat on Cash and Savings

Cash and savings are subject to Zakat if they meet the Nisab threshold. This includes:

- Cash: Add the total cash in hand and in bank accounts. If it exceeds the Nisab, apply the 2.5% rate.

- Savings: Calculate the total value of savings in traditional accounts, investments, or retirement funds. Convert the total into CAD and apply the 2.5% Zakat rate.

Zakat on Bank Balances

Zakat on bank balances involves:

Summing up all accounts, including savings, checking, and interest-bearing accounts (purify interest by donating it to charity).

If the total meets the Nisab, apply the 2.5% rate.

Zakat on Income

Zakat on income is calculated on net earnings after essential expenses:

For salaried individuals, calculate Zakat on the remaining income after covering necessary living costs, applying 2.5% if it meets the Nisab.

Zakat on Investments

Investments, including stocks, bonds, and funds, are also subject to Zakat:

- Stocks: Calculate 2.5% on the current market value.

- Bonds: Zakat is due on the principal amount, while interest should be donated to charity.

- Mutual Funds and ETFs: Calculate Zakat on the net value of holdings.

- REITs: Apply Zakat on the value of shares and generated income if above the Nisab.

Zakat on Property

Real estate, including property held as an investment, is subject to Zakat. However, the primary residence is typically exempt.The calculation of Zakat on property requires a thorough understanding of the value of the property and how it is treated under Islamic law.

In Canada, where real estate investments are common, it is important to accurately assess the value of all property holdings and ensure that Zakat is calculated correctly. By doing so, Muslims can fulfill their religious obligations and ensure that their wealth is purified.

Zakat on Mortgage

When calculating Zakat on property with a mortgage, only the equity in the property (the market value minus the remaining mortgage balance) is considered.

If this equity exceeds the Nisab, Zakat is due on it. This requires a thorough understanding of the value of the property, the remaining mortgage balance, and how these factors are treated under Islamic law.

In Canada, where mortgages are common, it is important to accurately assess the equity in property holdings and ensure that Zakat is calculated correctly. By doing so, Muslims can fulfill their religious obligations and ensure that their wealth is purified.

Example of Zakat Calculation in CAD

To provide clarity, let’s walk through an example of Zakat calculation in Canadian dollars.

Suppose a Muslim in Canada possesses the following assets:

- 50 grams of gold

- $5,000 in cash savings

- $10,000 in a checking account

- $20,000 in stocks

First, determine the current market value of 50 grams of gold in Canadian dollars. If gold is valued at $80 per gram, the total value would be $4,000. The cash savings, checking account balance, and stocks total $35,000.

The total assets subject to Zakat are $39,000 CAD. Since this amount exceeds the Nisab, Zakat is calculated as 2.5% of $39,000, which equals $975 CAD.

Best 2024 Zakat Calculators in Canadian Dollar

For Muslims in Canada, accurately calculating Zakat in Canadian dollars is essential to fulfilling this important religious obligation.

Fortunately, several reputable online tools can simplify this process by ensuring that all calculations are performed in accordance with Islamic principles.

These calculators are invaluable for Muslims in Canada who seek to fulfill their Zakat obligations with accuracy and ease. By using these trusted tools, individuals can ensure that their Zakat is calculated correctly and that their wealth is purified in accordance with Islamic teachings.

Here are some of the most popular Zakat calculators:

Zakat Foundation Calculator

The Zakat Foundation’s calculator is a widely used tool that allows users to input various assets, such as cash, savings, gold, and investments, and calculates the total Zakat due in CAD.

This user-friendly calculator is especially helpful for those with complex financial portfolios, offering a comprehensive approach to Zakat calculation.

NZF Canada Zakat Calculator

Developed by the National Zakat Foundation Canada, this calculator is tailored specifically for Muslims living in Canada. It considers local financial conditions and provides accurate Zakat calculations based on assets in Canadian dollars.

The NZF Canada calculator is particularly useful for those who want a tool designed with the Canadian financial landscape in mind.

Islamic Relief Zakat Calculator

Islamic Relief offers a well-known Zakat calculator that is easy to use and highly accurate.

Users can enter their wealth details, including gold, cash, and investments, and receive an immediate calculation of their Zakat obligation in CAD. This calculator is trusted by many for its reliability and simplicity.

Zakat.com Calculator

Zakat.com provides an online calculator that is popular among Muslims worldwide, allowing for the input of different types of assets and automatically converts their value to Canadian dollars.

It ensures that the Zakat calculation is precise and up to date with current exchange rates. This tool is particularly favored for its comprehensive approach and ease of use.

Zakat Donation & How to Pay

After calculating the amount of Zakat due, the next critical step is to distribute it correctly.

Zakat must be given to specific categories of recipients as outlined in the Quran, such as the poor, the needy, and those burdened by debt. Ensuring that Zakat reaches those who are most in need is a fundamental aspect of fulfilling this obligation.

How to Pay Zakat in Canada

- Choose a Reputable Charity: In Canada, numerous Islamic charities and organizations are authorized to collect and distribute Zakat. These include organizations like Islamic Relief Canada and National Zakat Foundation Canada, which ensure that Zakat is allocated according to Islamic principles.

- Donate Online: Many of these organizations provide online platforms where you can easily calculate your Zakat and make your donation. This method is particularly convenient, allowing you to pay Zakat directly in Canadian dollars (CAD). It’s essential to donate in CAD to ensure the full value of your Zakat is transferred to the recipients without any loss due to currency conversion.

- Specify the Purpose: When making your donation, be sure to specify that it is for Zakat. This ensures that the funds are used strictly for the purposes outlined in Islamic law, such as supporting the poor, the needy, and those in debt.

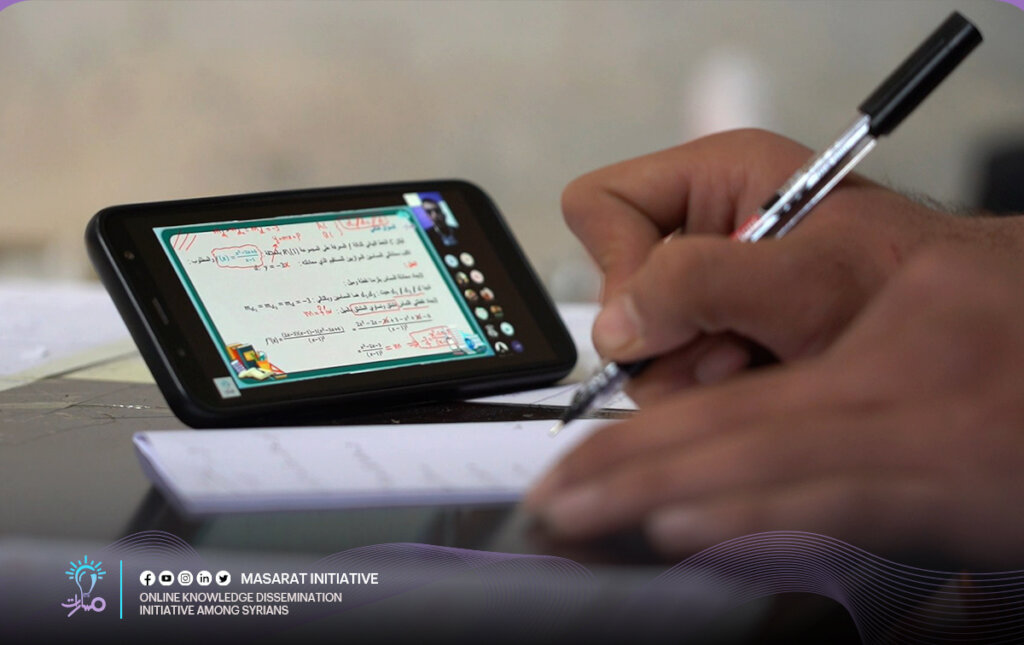

- International Support: Beyond Canada, you can also contribute to international humanitarian initiatives. For instance, initiatives like Masarat provide free online education to vulnerable Syrian students, including orphans and those living in camps. Such donations, though international, are still valid as Zakat if they support those who qualify under the specified categories.

- Confirm Compliance: Ensure that any organization you donate to is compliant with Canadian regulations and Islamic guidelines. For example, donations to initiatives like Masarat are secure and certified, such as being licensed by GlobalGiving 501c.

By following these steps, Muslims in Canada can fulfill their Zakat obligations with confidence, knowing that their contributions are making a real difference in the lives of those in need, both locally and internationally.

Masarat Initiative for Education and Youth Empowerment in Northern Syria

Driven by our humanitarian and societal duty, Masarat Initiative was launched to support children and youth in Northern Syria in the areas of education, care, and other related services.

Our entirely free initiative targets the most affected groups, such as orphans, individuals with special needs, those who have been out of school for extended periods, and those residing in displaced persons’ camps.

Masarat Initiative stands out by offering the opportunity for those who wish to donate and contribute to humanitarian causes through donating their gold zakat to the initiative’s fund. This support aims to help our children, providing them with a pathway to a future that can save them from their current suffering and deprivation.

In conclusion, calculating Zakat in Canadian dollars is a critical responsibility for Muslims living in Canada. By understanding the principles of Zakat and utilizing accurate tools like the Islamic Relief Zakat Calculator or the NZF Canada Zakat Calculator, individuals can ensure they meet their obligations with precision.

Whether calculating Zakat on gold, cash, investments, or property, it is essential to consider the unique financial landscape of Canada and convert all values to CAD.

This meticulous approach not only fulfills a religious duty but also contributes to the betterment of the community, reinforcing the values of compassion and social justice that are central to Islam.

Through careful calculation and thoughtful distribution of Zakat, Muslims in Canada can purify their wealth and support those in need, strengthening the bonds within the Ummah and beyond.