one of the Five Pillars of Islam, is a mandatory act of worship required of its followers. Having knowledge or a means to easily calculate it ensures its timely disbursement without falling into the sin of delay or prepayment as commanded by Allah the Almighty.

This article discusses the zakat calculator and how to calculate your zakat in different currencies, specifically in dollars and euros, and introduces the top 7 online zakat calculation programs.

What is a Zakat Calculator?

A zakat calculator is a tool designed to calculate the zakat value according to the regulations set by Allah the Almighty for His worshippers, determining the amount of zakat that must be paid from the wealth of the person paying zakat.

How to Calculate Zakat by Currency

Cash currencies like the euro and the dollar are zakatable if they reach the nisab (minimum amount upon which zakat is due), which is equivalent to 85 grams of gold or more. Zakat is paid in the same currency or its equivalent in another currency at the time zakat is due.

There are two methods to calculate zakat depending on the currency:

Divide the zakat amount by 40 For instance

if you have $5,000 and want to pay zakat, the calculation is as follows: $5,000 ÷ 40 = $125, and you must pay $125.

Divide the amount by 100 and then multiply the result by 2.5

With the same amount of $5,000, the calculation is: $5,000 ÷ 100 = 50 × 2.5 = $125, which is the zakat amount you must pay.

Calculating Zakat in Euros

When the zakat payer’s wealth is in euros, the amount in euros is compared to the gold equivalent. If it equals 85 grams of gold, 2.5% of the amount is paid as zakat.

Zakat Calculator in Dollars

The currency does not affect the zakat calculation because it is equivalent to gold. If the zakat payer chooses to pay zakat in dollars, the gold price in relation to the dollar must be assessed. If it reaches the nisab, 2.5% must be paid.

Calculating Zakat on G old

Calculating zakat on gold is a precise process that requires following specific steps to ensure compliance with Islamic law.

First, the total weight of the gold owned by the individual is determined, and this weight is collected in grams. Next, this weight is compared to the minimum threshold (nisab) set by Islamic law, which is 87.48 grams of gold.

If the total weight of the gold equals or exceeds this nisab, zakat becomes obligatory. The current market value of gold per gram is then determined, and the total weight of the gold is multiplied by this value to obtain the total value of the gold. After calculating the total value, zakat is calculated at 2.5% of this value.

This process ensures that zakat is paid correctly and helps in supporting those in need and the broader community.

Top 6 Online Zakat Calculation Sites

1- Zakat Fund This platform allows calculating zakat according to the United Arab Emirates and its nisab value.

2- Zakat House A platform from Kuwait, where you can calculate zakat on gold in various weights. It allows calculations according to the Hijri or Gregorian calendar and choosing the appropriate currency for zakat calculation.

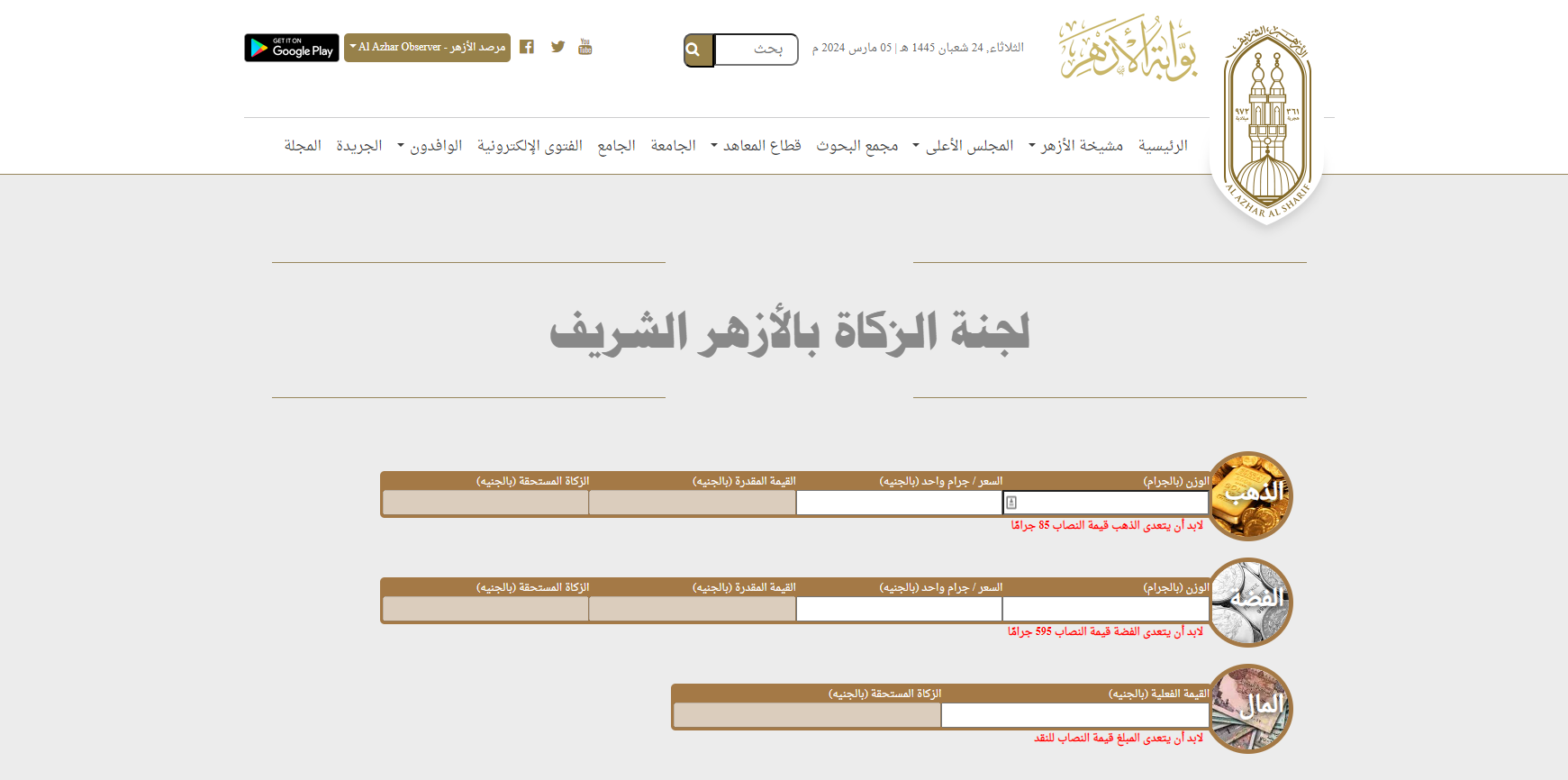

3– Calculate Your Zakat Associated with the Al-Azhar platform, allowing calculations of zakat on gold, silver, and money.

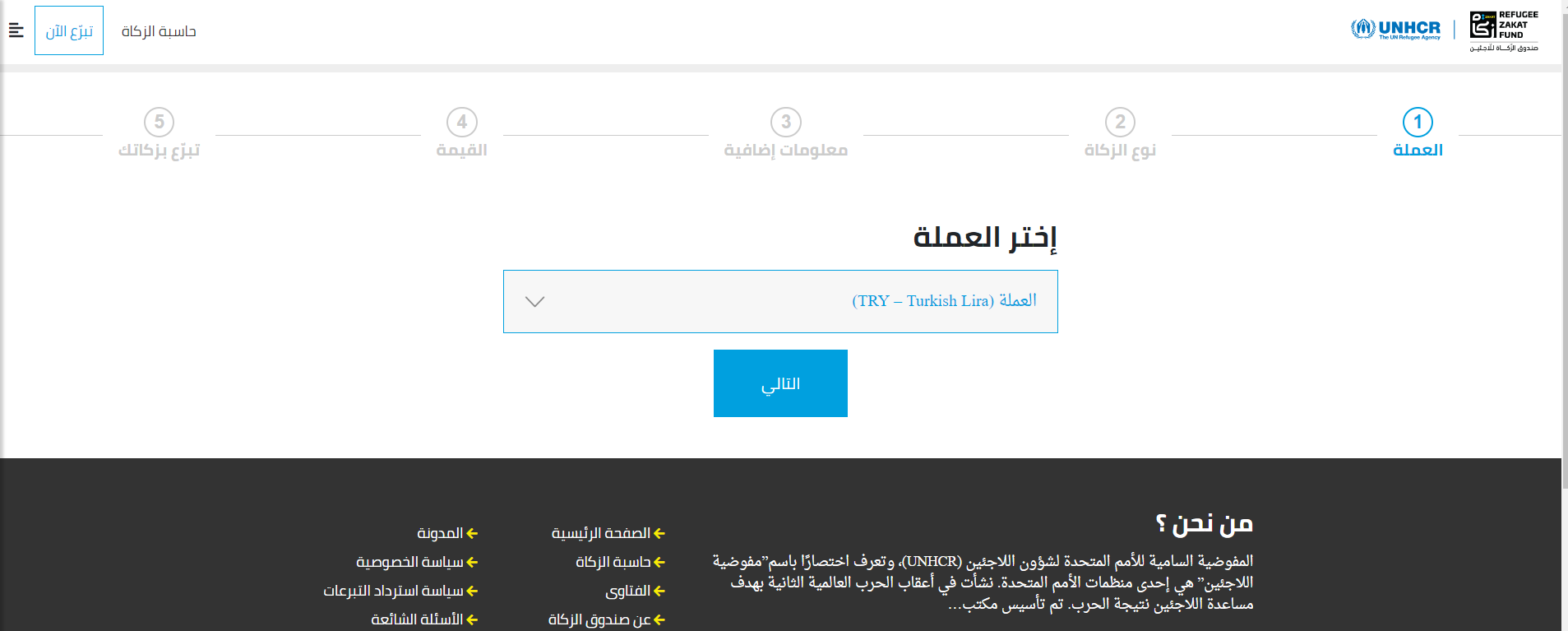

4- Zakat Calculator Affiliated with the United Nations platform, offering accurate zakat calculations by entering required information.

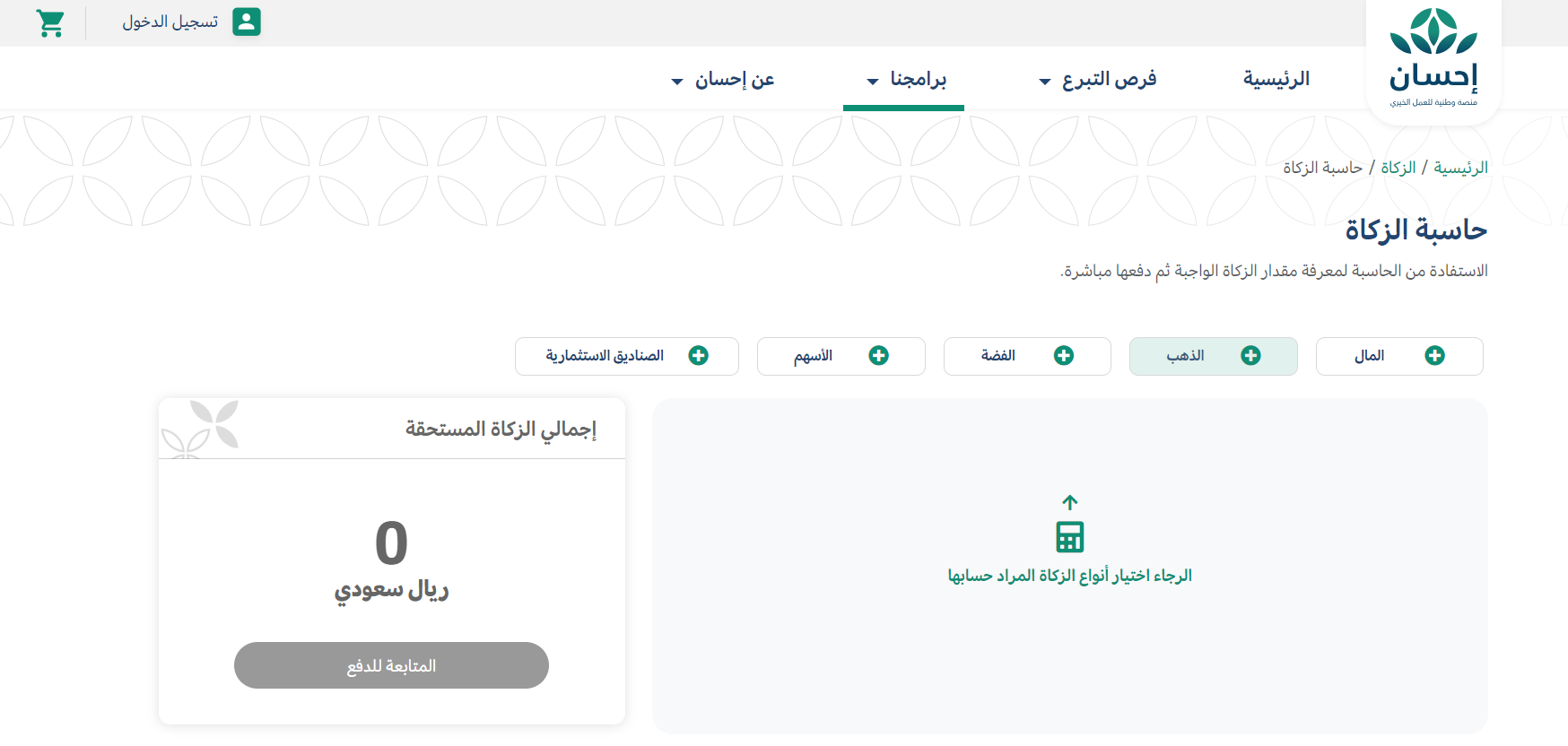

5- Zakat Calculator Part of the Ehsan platform, featuring calculations of zakat on money, stocks, silver, and gold.

6– Zakat Calculator Belonging to the Ahl Masr organization, it enables calculation of zakat on money, real estate owned, and stocks.

Masarat for Education and Knowledge Dissemination in Syria

Masarat Initiative aims to provide free education for students in need to continue their education and enroll in classes, offering online education to address all community segments, especially those affected like orphans, those with special needs, displaced persons, and refugees.

We offer various educational, knowledge-based, and academic services, focusing on developing all aspects for students to be well-prepared for their professional life.

You can donate your zakat to support our initiative in providing online education and supporting this knowledge-thirsty group, in accordance with our scholars’ views on the permissibility of disbursing zakat for religious and worldly knowledge.