The obligation of Zakat in our noble religion embodies significant humanitarian meanings towards ourselves and others, such as altruism and prioritizing public benefit over individual interest. It is one of the most important Islamic religious duties that Allah Almighty has made obligatory for His servants, offering great reward and blessing to the Muslim who gives Zakat from their wealth.

In this article, we shed light on one aspect of Zakat, specifically Zakat on 18-karat gold. We discuss its conditions and rulings in our noble religion, including its Nisab (minimum amount required for Zakat to be due) and how to calculate it as legislated by the religion. We conclude with some of the most common questions on this topic.

Zakat Ruling for 18-Karat Gold

The Zakat ruling on 18-karat gold varies depending on its intended use, whether for adornment or trade, following the opinions of Muslim scholars on the obligation of Zakat on gold based on its purpose of acquisition.

18-karat gold is considered adulterated, not pure gold. However, Zakat can be given from it if the amount of pure gold within reaches the Nisab of twenty Mithqals, equivalent to 85 grams.

Imam Al-Kasani Al-Hanafi stated in his book (Bada’i al-Sana’i in the arrangement of Sharia laws) that since jewelry represents wealth beyond basic needs, as preparation for beautification indicates surplus over primary needs, it is a blessing for the enjoyment it brings, necessitating its gratitude by allocating a portion of it for the poor… Regardless of whether it is held for trade, expenses, or adornment, or without any particular intention.

Conditions for Zakat on 18-Karat Gold

Zakat on 18-karat gold is obligatory when the following conditions and rules are met:

- It reaches the Nisab, meaning the total pure gold equals 85 grams.

- A full lunar year (Hijri year) has passed since its acquisition.

- Its ownership belongs entirely and exclusively to the Zakat payer.

Nisab for 18-Karat Gold

The Nisab for Zakat on 18-karat gold is the same as for all types of gold, which is 85 grams of pure gold.

However, 18-karat gold is not pure and contains other metals in its composition; therefore, a Muslim must revert it to its base form and calculate the amount of pure 24-karat gold present in it.

How to Calculate Zakat on 18-Karat Gold

Calculating Zakat on 18-karat gold can be done simply, as demonstrated by the following example:

If you own a 1000 gram 18-karat gold bar, the calculation for the pure gold content is as follows:

1000 x 18 ÷ 24 = 750 grams of 24-karat gold, on which Zakat is due.

Therefore, Zakat should be given at the rate of one-quarter of a tenth, which equals 2.5% of the total grams of gold.

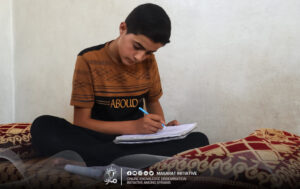

Masarat for Education and Youth Empowerment in Northern Syria

Because Masarat is committed to the teachings of our noble religion in assisting and supporting every needy Muslim, striving to be a bridge in initiatives of kindness and generosity through its goal of providing free educational opportunities for those in need to continue their studies and secure their future, believing in the importance of facilitating access to knowledge for learners everywhere, especially in Northern Syria for those suffering from the effects of war and conflict, it opens the door for donating gold Zakat to the initiative’s fund to contribute to achieving a better life for those who truly need this help. May Allah accept it from us all.

Frequently Asked Questions About Gold Zakat

Is there Zakat on used gold?

To answer precisely, it’s essential to know whether the gold is intended for saving or adornment. While the former is obligatory for Zakat among Muslim jurists, the latter is subject to disagreement; thus, giving Zakat on used gold is considered the best decision regardless of the gold’s purpose.

Ruling on Zakat for Jewelry Intended for Use

Some scholars mandate Zakat on adornment gold if it reaches the Nisab, while others see no obligation for Zakat on gold used for adornment even if it reaches the Nisab. It’s preferable to give Zakat on the gold as a precaution to avoid disagreement and assist the poor.

Is there Zakat on stored or hoarded gold intended for acquisition?

Islam obligates giving Zakat on gold intended for saving or hoarding for trade, with a consensus among scholars.

Al-Nawawi said: “Our companions said: If one made jewelry and did not intend it for prohibited, disliked, or permissible use, but rather for hoarding and acquisition, the correct opinion and the consensus of the majority is that Zakat is obligatory on it.”

Is Zakat on gold due every year?

It’s not sufficient to give Zakat on gold only once; rather, giving Zakat on gold is an obligatory duty on a Muslim every year if the gold reaches the Nisab and meets all conditions for gold Zakat.

Is it permissible to give gold Zakat in cash?

Islam allows giving gold Zakat in cash, provided that the Zakat-due gold is assessed, then one-quarter of a tenth of its value at the time of giving Zakat is paid.

It’s important to note that the timing of Zakat payment, not the obligation time, is crucial because the intent is to give Zakat on the actual gold. If one-quarter of a tenth of it is not given, one must give one-quarter of a tenth of its value.

How to determine the weight of gold for Zakat?

It’s preferable to weigh the Zakat-due gold on an accurate scale designed for precious weights, like those used by gold sellers.

Is Zakat on gold required every year, or is once enough?

Zakat on gold that reaches the Nisab is paid every year, upon a full year’s passage from the time of its first possession. Zakat is due at the beginning of the year if it reaches the Nisab, which is twenty Mithqals, equivalent to 85 grams of gold.

Is it permissible to give gold Zakat to relatives or family members?

Paying Zakat to poor relatives is permissible as charity and kinship because the Prophet (peace be upon him) when asked, said: “Charity to the poor is charity, and to the relative is two things: charity and connecting ties.” Therefore, a Muslim may give his brother, uncle, or maternal uncle Zakat or voluntary charity if they are poor, as charity and connecting ties. However, if the poor person is a parent or grandparent, or children, they should not receive Zakat because it’s obligatory to provide for them or if they are descendants, they should not be given from Zakat; the parent is more entitled to spend on them, and the same goes for the mother if she is able and they are incapable.