Allah Almighty has mandated Zakat on His servants as a guide and directive on how to spend their wealth in ways that benefit them and the Muslim community. This obligation comes with specific conditions and rulings to simplify the process for them.

This article discusses the rulings, conditions, and Nisab (minimum amount required for Zakat to be due) for Zakat on 24-karat gold – pure gold devoid of any other metals. We will also answer some of the most common questions on this topic.

Ruling on Zakat for 24-Karat Gold

Islam mandates Zakat on 24-karat gold if it reaches the Nisab of twenty Mithqals or 85 grams and is among the types of gold on which Zakat is obligatory, such as gold used for saving wealth.

It’s worth noting that 24-karat gold is the standard used to determine the Nisab for gold, whether the weighed gold reaches the Nisab or not. Unlike 18 or 21 karat gold, which contains other metals, 24-karat gold is pure.

Conditions for Zakat on 24-Karat Gold

The conditions for Zakat on 24-karat gold are twofold:

- A Hijri year must have passed since acquiring the gold.

- The gold reaches the Nisab, meaning the total amount owned is twenty Mithqals, equivalent to 85 grams of gold.

Nisab for 24-Karat Gold

Islam sets the Nisab for Zakat on 24-karat gold, as with other types of gold, at a minimum of 85 grams.

It is always recommended to weigh the gold on a specialized scale when calculating the Nisab for Zakat on 24-karat gold to ensure the accuracy of Zakat payment.

How to Calculate and Pay Zakat on 24-Karat Gold

How can you calculate Zakat on your 24-karat gold?

Given that 24-karat gold is considered for Zakat due to its purity, if it meets the conditions for Zakat, the due amount is “one-quarter of a tenth” of its total value.

As for its payment, Islam allows it to be paid from the gold itself or its equivalent value in cash at the time of Zakat payment.

Masarat for Education and Sustainable Development in Northern Syria

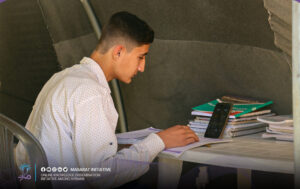

At Masarat, we focus our efforts on the educational aspect to support Syrian students and children who have faced many hardships and been deprived of their right to education. Our services are characterized by a humanitarian approach that prioritizes supporting these students entirely free of charge, hoping to be a genuine helping hand that leads them to safety anew.

If you wish to contribute with us, you can pay your gold Zakat in support of our initiative, helping it expand its services and reach more affected individuals in Northern Syria.

Frequently Asked Questions About Gold Zakat

How is Zakat calculated for a gold shop / How does a gold trader pay Zakat on their inventory?

Zakat is obligatory on all traded items, even if they are not inherently subject to Zakat. To calculate Zakat for a gold shop:

Pay one-quarter of a tenth of the owned gold collectively.

The owned gold must be evaluated at the current selling price – not the purchase price – then 2.5% of its value is paid.

How to calculate gold Zakat in Saudi riyal?

Calculating gold Zakat in Saudi Riyals can be done simply by calculating the total gold amount to be paid in Zakat, then paying “one-quarter of a tenth” of it. For example, from 1000 Riyals, 25 Saudi Riyals are to be paid.

Is it permissible to pay gold Zakat in installments?

Islam allows the payment of gold Zakat in installments, which comes in two cases:

- Paying it before its due, i.e., (prepaying Zakat) before the completion of the year, like someone who gives their Zakat as a monthly salary to a poor family. At the year’s end, they calculate what has been paid in Zakat; if it’s less than what is due, they pay the remainder, and if more, the excess is considered charity.

-

- Paying Zakat in installments after its obligation is only permissible for a valid reason or benefit, as it’s not allowed for the wealth owner to keep the Zakat and pay it in installments without a significant reason, such as waiting for a close needy person or in case the wealth is not present or there’s no Zakat recipient in their country.