With the diversification of financial assets in our era, discussing zakat and its rulings requires a deep understanding due to the variety and differences of zakatable assets, whether it be gold, crops, fruits, or even land.

Today’s article will review zakat on land as an important type of zakat, its amount, legislative rulings, and its role in promoting social justice and sustainable development.

What is Zakat on Land?

Zakat on land represents a significant aspect of zakat rulings, where a Muslim is required to pay a specific amount of money as zakat for the land they own, based on their intention when purchasing it. Lands designated for residential use are not subject to zakat according to the Maliki, Shafi’i, and Hanbali schools of thought, while those intended for agricultural or investment purposes require zakat based on the crops produced or income from rent, with the necessity of defining the intention upon purchasing the land.

Is Zakat Due on a Plot of Land?

Yes. The obligation of zakat on land primarily depends on the owner’s intention and purpose for owning it. Here’s a detailed explanation:

- Land designated for personal use and residence does not attract zakat, based on the prophetic saying, “There is no zakat due on a Muslim’s horse or slave.”

- Land purchased with the intention of agricultural investment is only subject to zakat through what it produces of crops.

- Land bought with the intention of investment and resale is treated as trade goods, and zakat is due based on the intention to grow wealth through sale.

Amount and Nisab of Zakat on Land

The nisab (minimum amount for zakat liability) for agricultural land differs from that for investment land. Therefore:

- Land prepared for sale requires the owner to pay “one-quarter of a tenth,” i.e., 2.5% of its total value after a year.

- Commercial lands pay 2.5% of the profits they generate.

- Agricultural lands’ zakat is determined based on the actual produce of crops and fruits.

If a landowner is undecided about selling or keeping the land for residence or investment, zakat is not due because the obligation of zakat depends on the owner’s clear intention from the beginning.

Cases and Rulings on Zakat for Land in Islam

Zakat on Land Purchased for Wealth Preservation:

If land is bought with the intention of preserving wealth and selling it later, zakat is due as with any trade goods. The zakat amount is calculated as “one-quarter of a tenth” of its market value after a year, provided the intention was clear from the beginning.

Zakat on Lands for Wealth Preservation:

If land is bought with the intention of wealth preservation without plans for sale, no zakat is due, as the basis for land zakat is the intention of trade and sale.

Timing and Method of Discharging Zakat on Land

The basis of zakat on land is its sale and purchase, i.e., its commercial use. If a year passes with this purpose and intention, zakat should be discharged at the end of the lunar year after assessing its market value and paying “one-quarter of a tenth” of its value.

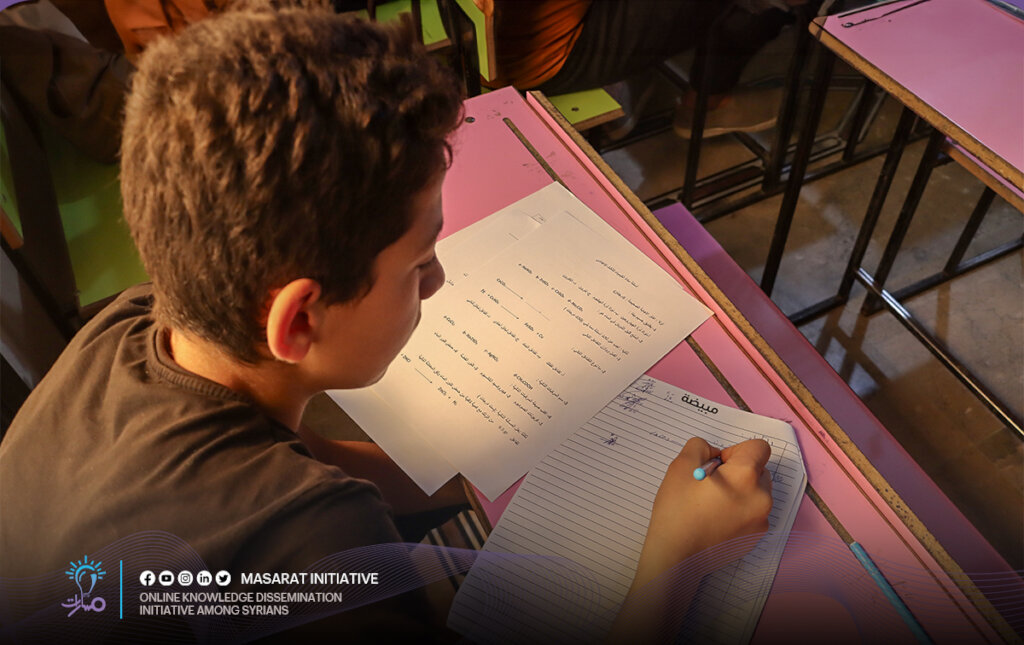

Masarat for Education and Knowledge Dissemination in Syria

Masarat’s educational initiative, a volunteer non-profit project, was developed in response to the urgent need of students for education and knowledge. This initiative offers the opportunity for education as a gateway to a new life away from the hardships of war and displacement, focusing especially on Syrian students facing significant challenges and still striving to achieve their dreams. The main goals of this initiative are:

- Providing free online school education to all Syrians.

- Securing university scholarships for students who have completed their secondary education through Masarat.

Your donations and zakat contributions help deliver knowledge and science to every needy student and those dreaming amidst the rubble.

Zakat is obligatory on saved money regardless of the saving goal, whether for purchasing land or building a house, as long as the conditions of zakat, including the passage of a year and reaching the nisab, are met. If the intention of purchase is solely for wealth preservation, no zakat is due, while zakat becomes obligatory if the intention is to sell for profit. There is no zakat on land designated for construction, as zakat is only imposed on lands used for commercial purposes with the intent of profit. The zakat for resources extracted from the earth, like oil, is set at 20%, while a zakat rate of 2.5% is imposed on precious metals like gold and silver. Zakat is obligatory on lands intended for sale and purchase, as they are treated as trade goods.Frequently Asked Questions About Zakat on Land

Ruling on Zakat for Money Saved to Purchase Land or Build a House

Is Zakat Due on Land Purchased for Wealth Preservation?

What is the Ruling on Zakat for Land Left for Time of Need?

Zakat Rate for Resources Extracted from the Earth

Which Lands are Subject to Zakat?