Zakat on wealth represents one of the foundational pillars of the Islamic financial system, aimed at supporting needy groups and achieving social balance. Understanding how to calculate zakat according to the nature of wealth and the different categories that necessitate it, based on prophetic traditions and agreed-upon jurisprudential rulings, is essential.

Our next article invites you to learn about this obligation, how to calculate it, and the legal foundations it rests upon, in addition to highlighting its vital role in supporting humanitarian initiatives.

Types of Wealth Subject to Zakat in Islam

Scholars have unanimously agreed on the types of wealth that are subject to zakat, based on traditions narrated from the Prophet (PBUH) and jurisprudential rulings agreed upon by jurists. These can be classified as follows:

- Gold and silver, alongside currency notes that replace gold in current financial transactions

- Fruits, crops, and all produce of the earth that are stored and measured.

- Livestock, including sheep, cows, and camels.

- Trade goods, which are everything owned with the intention of profit, such as through buying and selling.

Ibn Taymiyyah, in “Majmu’ al-Fatawa,” relayed from Ibn Mundhir that, “Scholars have unanimously agreed that zakat is obligatory on nine items: camels, cows, sheep, gold, silver, wheat, barley, dates, and raisins, whenever each category reaches the amount on which zakat is obligatory.”

Does Zakat Apply to Non-Growing Wealth ?

Zakat must be paid on wealth when it reaches the specified nisab (minimum amount) provided that the amount is stable and capable of growth; then, a yearly zakat of 2.5% is due after a full lunar year has passed.

Calculating Zakat on Fluctuating Wealth that Increases and Decreases

In the case of fluctuating wealth , calculating its zakat requires the fulfillment of two essential conditions:

- The wealth reaches the nisab, which is the equivalent of 85 grams of gold.

- The amount remains stable for a lunar year without decreasing below the nisab.

As such, the zakat on wealth is calculated to be 2.5%. However, if the wealth decreases below the nisab before the completion of the lunar year, then no zakat is due on it.

Zakat on Frozen Wealth that Decreases

the nisab specified as 85 grams of gold and maintains this limit or exceeds it throughout the year, then zakat becomes obligatory at a rate of 2.5%. The amount remains eligible for zakat even if it decreases, provided it does not fall below the nisab threshold.

However, if the decrease is below the nisab before the completion of the lunar year, then zakat is not due on it.

Zakat on Increasing, Growing Wealth

by the consensus of jurists, is obligatory on all types of wealth , including growing wealth , provided its essential condition of reaching the nisab and completing a lunar year is met.

Zakat Expenditures According to Islamic Law

Zakat expenditures are the categories entitled to zakat funds, as specified by Allah in His noble book: “Charities are for the poor, the needy, those employed to collect [zakat], those whose hearts are to be reconciled, for slaves’ freedom, for those in debt, in the cause of Allah, and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise.”

To clarify further, the intended categories include:

- Those employed to collect zakat.

- New Muslims who are supported financially to strengthen their faith and conviction.

- Debtors who cannot pay off their debts.

- In the cause of Allah, which includes jihad-related activities.

- Students dedicated to Islamic studies.

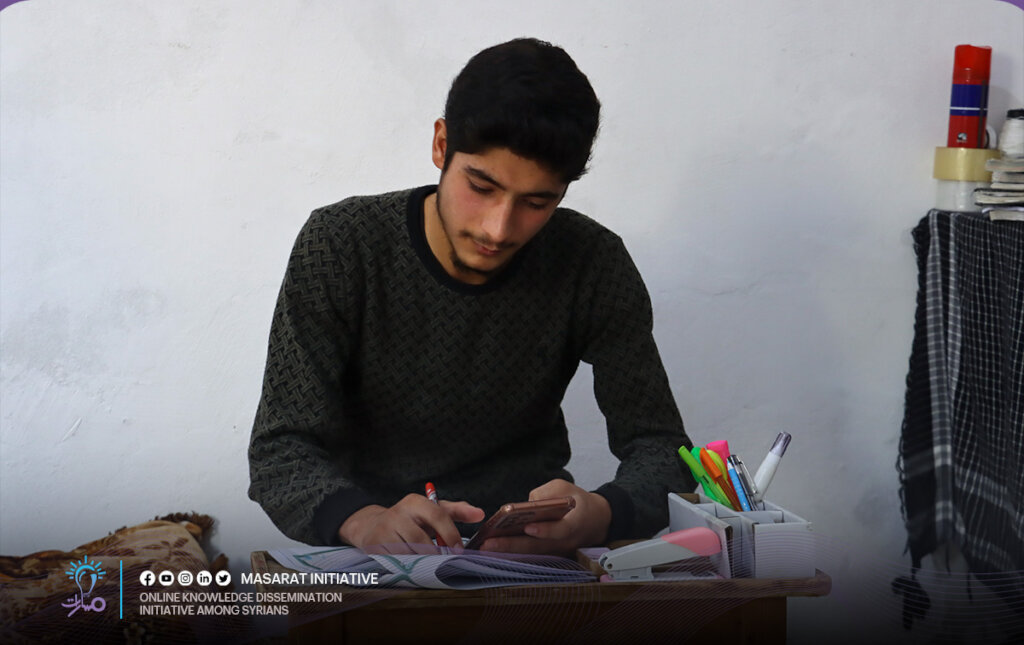

Masarat Initiative for Empowering Youth in Northern Syria

Masarat for Education, a free online educational initiative, enables students to continue their studies without any financial costs or burdens. Through your donations and zakat funds, the Masarat initiative draws strength to continue its journey towards achieving our youth’s hopes for a brighter and better future.

Frequently Asked Questions on Zakat on Wealth

Is Zakat Due on Fixed Assets?

Zakat is not imposed on fixed assets that do not generate profits for their owner. Instead, it is only due on assets that yield gains and profits.

Is There Zakat on Saved Money?

Zakat is obligatory if this money reaches the nisab and a lunar year has passed over it, at which point it should be paid annually without interruption.

Is Zakat on Wealth Combined with Gold?

Money is considered a substitute for gold and silver. If the owned money, when added to the existing gold, completes the nisab, it is obligatory to combine them and pay the due zakat.

Is Gold Included in the Wealth for Zakat?

Current money acts as a substitute for gold and silver, and combining them to complete the nisab necessitates the payment of zakat.

Is Money Combined with Gold for Zakat?

If the owned money equals 85 grams of gold, it is required to add the gold to it and pay zakat at the rate of “one-quarter of a tenth” of the total amount.

How to Properly Perform Zakat?

First, calculate the zakat correctly at 2.5% of the wealth, then distribute this zakat to those entitled to it as mentioned in the Quran.

When is Zakat on Wealth Waived?

Zakat on wealth is waived if the total amount does not reach the nisab by the end of the lunar year.

Is Zakat Obligatory on Non-Growing Wealth?

Yes, the condition for zakat is not the growth of the wealth but its reaching the nisab, equivalent to 85 grams of gold, and that a lunar year has passed over it.

Is Zakat on Wealth Paid on the Principal or the Profits?

Zakat is paid from the total wealth, including both the principal and the accumulated profits, without needing a new lunar year for the profits added to the principal.

What Wealth is Exempt from Zakat?

Zakat is not due on personal belongings such as furniture, clothes, cars, food, or on wealth that does not reach the specified nisab by the end of the lunar year.

Is Zakat Due on Frozen Wealth?

Zakat is imposed on wealth that reaches the nisab and is accessible, while it is not imposed on restricted wealth until it becomes accessible and a full lunar year has passed after gaining access, provided it completes the nisab.

Is It Permissible to Pay Zakat on Wealth for Feeding a Fasting Person?

It is preferred to pay zakat from the same type of wealth being zakated. It should be paid in cash, allowing the poor to use it according to their needs, and it is not necessary to pay zakat on wealth in the form of food for feeding fasting people.