Building on the previous articles, donating to charitable organizations not only supports meaningful causes but also provides substantial tax benefits for both individuals and businesses.

Whether you are contributing to local food banks or international humanitarian efforts, charitable donations can significantly reduce your tax burden while enhancing financial flexibility.

This article will delve into the tax benefits of charitable giving, examine how these contributions influence your taxes, and highlight the best practices for maximizing deductions.

Tax Donations To Charity

Charitable donations refer to contributions made to IRS-recognized nonprofit organizations. These can take the form of cash, property, stocks, or even time and effort in volunteer activities.

For these donations to qualify for tax benefits, the organization receiving the funds or support must have tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

Here are some ways charitable donations can be structured:

- Cash Donations: This is the most straightforward way to donate, with checks or online transactions directly benefiting charities.

- Non-Cash Donations: You can donate tangible goods like used clothing, electronics, vehicles, or even appreciated stocks and bonds. Real estate and artwork can also be considered, provided accurate valuations are available.

- Volunteer Expenses: While time spent volunteering isn’t directly deductible, the costs related to volunteering can be deducted, such as mileage or uniforms

Tax Benefits of Donating To Charity

The tax benefits of charitable donations depend on how the contributions are made and the taxpayer’s filing status. Some benefits include:

- Lowering Taxable Income: When you itemize your deductions, your charitable contributions can reduce your taxable income, potentially lowering the amount of taxes owed.

- Donor-Advised Funds: This tax-advantaged giving account allows donors to receive immediate tax deductions while recommending grants to various charities over time.

- Qualified Charitable Distributions (QCDs): Individuals aged 70½ or older can donate directly from their IRA to charities without incurring taxes on the withdrawal.

- Appreciated Asset Donations: Donating appreciated stocks or property allows donors to avoid capital gains taxes while receiving a deduction for the full fair market value.

How Do Charitable Donations Affect And Help Taxes?

Charitable donations directly impact your taxes by lowering taxable income or offering other financial incentives:

- Itemized Deductions vs. Standard Deduction: To receive the full benefits of charitable contributions, individuals must itemize their deductions rather than take the standard deduction. Itemizing allows you to include the total value of charitable contributions alongside other deductions.

- AGI Limitations: Most charitable contributions are capped based on a percentage of your adjusted gross income (AGI). For example, cash donations can typically be deducted up to 60% of your AGI. For non-cash donations or contributions to private foundations, different limits apply.

- Carryover Provisions: If your donations exceed the annual limits, the excess can be carried forward for up to five years.

Tax Benefits of Business Donating to Charity

Businesses can also gain several tax advantages by donating to charity:

- Enhanced Reputation: Charitable contributions can boost a company’s corporate social responsibility (CSR) profile, creating goodwill among customers and the public.

- Tax Deductions: C corporations can deduct up to 10% of their taxable income through cash or property donations. For other forms of business-like partnerships and S corporations, the deduction flows through to individual partners and shareholders.

- Inventory Donations: Donating inventory provides special tax benefits.

The value of the deduction is typically the cost of the donated goods, plus half the difference between the cost and fair market value.

How Much Can You Deduct From Charitable Donations?

The deductible amount for charitable contributions depends on the type of donation and the recipient organization:

- Individuals: Cash contributions to public charities can generally be deducted up to 60% of your AGI. For non-cash donations, the limit ranges between 20% to 50%, depending on the type of contribution.

- Corporations: C corporations can deduct up to 10% of their taxable income through charitable contributions. Excess contributions can be carried forward for up to five additional years.

- Non-Cash Donations: Donations of property or appreciated assets are subject to fair valuation requirements. It’s crucial to maintain proper documentation and valuations for these deductions.

Best Donate Time to Charity Tax Deduction

While the value of your time spent volunteering is not deductible, you can claim related expenses:

- Out-of-Pocket Expenses: Travel expenses, materials, and specialized equipment used in volunteering can be deducted if properly documented.

- Standard Mileage Rate: If you drive your vehicle for volunteer activities, you can deduct mileage at the IRS-established charitable mileage rate.

- Specialized Volunteer Services: Professionals providing specialized services like legal, accounting, or medical assistance can deduct the cost of related supplies or equipment used

Masarat Initiative Partner of Global Giving with 501(c)(3) Tax-Exempt Status

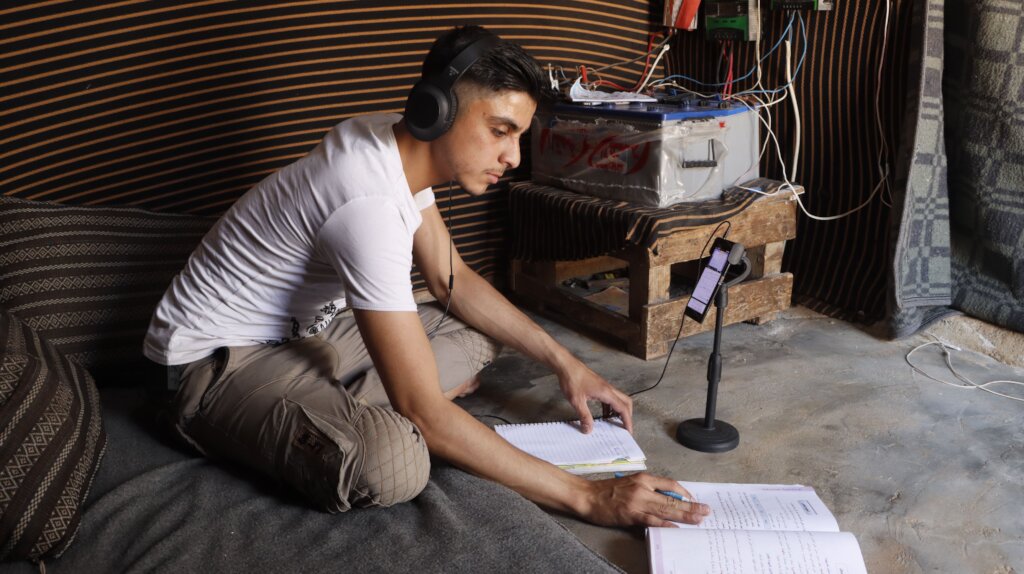

Through its partnership with Global Giving and the 501(c)(3) tax-exempt status, Masarat initiative provides free, comprehensive educational services to Syrian students in need. This includes orphans, the underprivileged, and those with disabilities living in refugee camps. By offering crucial tools, Masarat empowers individuals to join the job market confidently.

Since its inception, Masarat has supported more than 31,000 beneficiaries. As a charitable organization, it collaborates with Global Giving to benefit from 501(c)(3) tax exemptions in both the U.S. and the U.K. Donations to Masarat are tax-deductible, and a confirmation email will be sent to help with tax documentation.

Support Masarat with financial contributions, expertise, or strategic partnerships. Every donation, regardless of size, makes a difference in the lives of students and builds a brighter future for them and their communities