Zakat and sadaqah are among the most significant forms of worship in Islam, where a portion of a Muslim’s wealth is given to support and assist the poor and needy in meeting their needs.

To avoid confusion between the two, this article clarifies the main differences between these concepts, some jurisprudential rulings on the relationship between sadaqah and zakat on wealth, and concludes with frequently asked questions about sadaqah and its relation to zakat.

The Difference Between Zakat Al-mal and Sadaqah

What are the differences between zakat Al-mal and sadaqah? The distinctions can be summarized as follows:

The Ruling in Islam

Zakat is a mandatory act prescribed by Allah Almighty on the excess mal of a believer under specific conditions for its distribution, whereas sadaqah is a recommended act of giving a portion of one’s wealth to a specified cause without any obligations or mandate from Allah.

Form of Distribution

Zakat is obligatory on specific types of mal owned by Muslims, such as barley, wheat, gold, and silver, etc. There are no restrictions on sadaqah.

The Eligibility

Zakat Al-mal are given to specific individuals and groups mentioned by Allah Almighty in the Quran, and it is not permissible to give them to non-Muslims or those whom one is obliged to support financially, such as parents. Sadaqah can be given to anyone without restriction.

Restrictions on Distribution Location

Zakat is collected from the wealthy and given to the poor of the same country, whereas sadaqah can be given to anyone.

The Ruling on Creating a Sadaqah Jariyah from Zakat Al-mal

It is not permissible to create a continuous charity (sadaqah jariyah) from zakat Al-mal; because zakat is an obligation, unlike sadaqah, which is a voluntary act rewarded greatly by Allah.

The performance of zakat is subject to specific conditions and is given to certain categories – mentioned in the Quran – which do not necessarily apply to the mal of sadaqah.

Percentage of Sadaqah from Zakat Al-mal

Islam has not specified a percentage of sadaqah from zakat Al-mal, considering that doing so is not permissible in Islam due to the different jurisprudential rulings between these two concepts.

Giving sadaqah from one’s Al-mal is recommended by the Prophet and mentioned in many Quranic verses, but zakat is a legal obligation that differs from sadaqah, as each has a specific intent and condition, but both seek the pleasure of Allah Almighty.

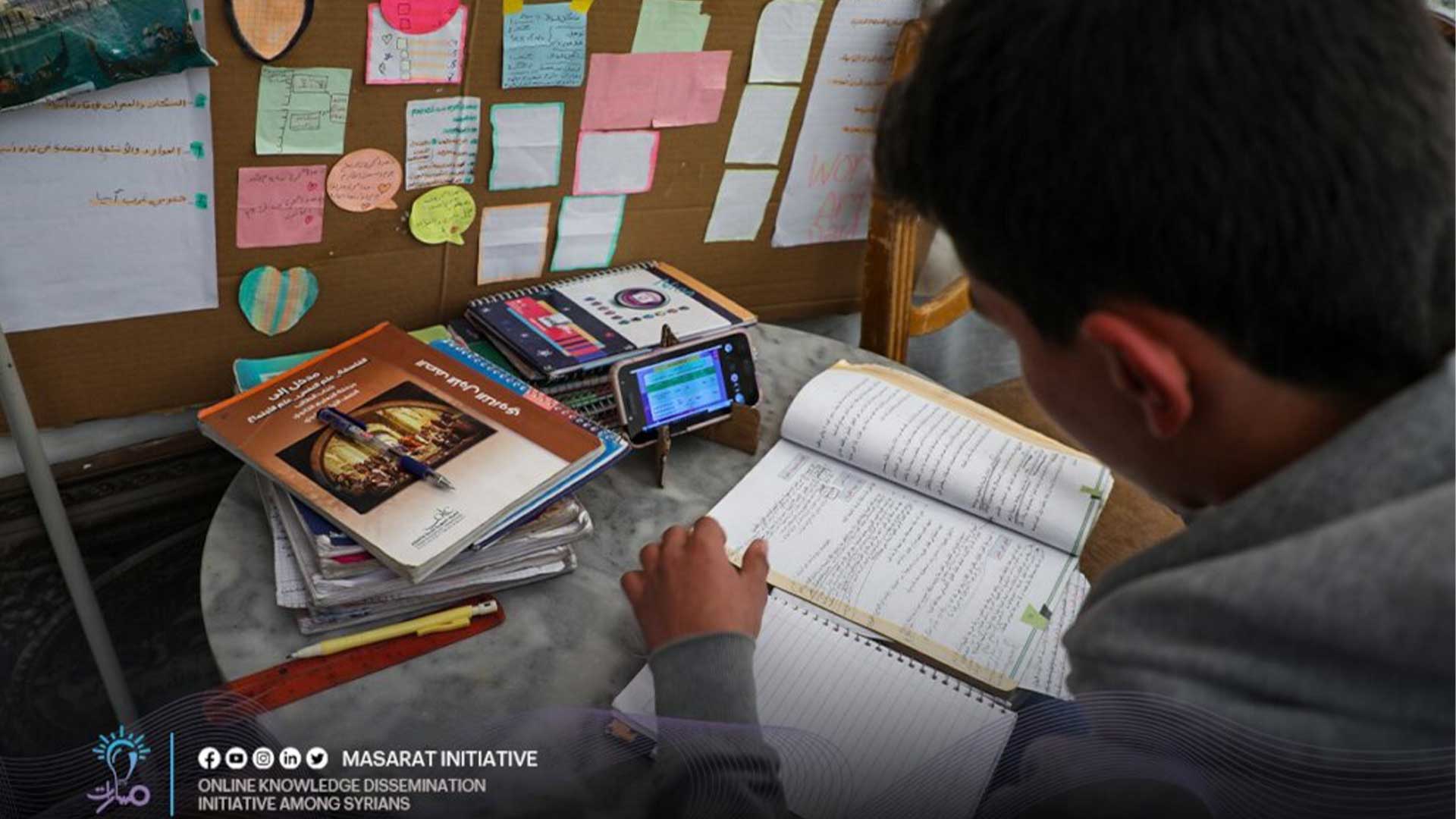

Masarat Initiative for Education and Knowledge Dissemination Online in Syria

In refugee camps and amidst the pains of life, orphaned children dream of studying, a dream not so difficult to achieve. Masarat confronts the challenges and difficulties of education in Northern Syria, offering free education and facilitating access to knowledge through an interactive online environment and non-interactive lessons via a Learning Management Platform, in addition to a knowledge endowment specifically for Masarat Initiative on YouTube.

Masarat believes strongly in the power of education and its role in building more stable societies. The primary goal is to expand the beneficiaries’ scope to make education a fundamental part of their lives.

You can also support and assist these children by channeling your donations through Masarat Initiative, which documents every amount sent to it.

Your zakat contribution reaches orphans and those in dire need of this support, fulfilling an act of goodness recognized by Allah, as He says: “Who is it that would loan Allah a goodly loan so He may multiply it for him many times over? And it is Allah who withholds and grants abundance, and to Him you will be returned.”

Your contribution to these children and youth represents the ultimate good you can offer them.

These orphans need opportunities for education and empowerment in the absence of their providers, to become positive and effective members of society.