Engaging in charitable giving is a powerful way to make a positive impact on the world while reaping personal financial benefits. When you donate to charity, not only do you support causes that are close to your heart, but you also gain the opportunity to lessen your tax burden.

“Tax Deductions for Charitable Donations” This symbiotic relationship between philanthropic support and financial advantage makes charitable giving particularly appealing.

For many, the prospect of reducing their tax liability while contributing to societal good is compelling. However, navigating the complexities of tax deductions related to charitable contributions can be daunting.

This guide is designed to delve deep into the intricacies of how these donations influence your taxes, providing you with comprehensive insights to maximize the benefits of your generosity. Whether you are a seasoned donor or considering your first charitable contribution, understanding the potential tax implications is crucial.

This article aims to demystify the tax implications of charitable contributions, helping you understand Tax Deductions for Charitable Donations

Do You Get a Tax Break for Donating to Charity?

Charitable contributions offer a dual benefit: supporting worthy causes and providing a tax break. When you donate to a charity recognized by the IRS as a 501(c)(3) organization, these donations can be deducted from your taxable income, which can result in a lower tax bill.

To benefit from this deduction, it’s imperative that you itemize your deductions on Form 1040, Schedule A.

The process requires precise documentation: for any donation over $250, the IRS mandates a written acknowledgment from the charity.

This acknowledgment must detail the amount of cash and a description of any property given, and whether the organization provided any goods or services in exchange for the gift. For contributions under $250, a bank record or a receipt from the charity sufficing.

It’s crucial to maintain meticulous records, as the IRS might request evidence of the contribution, such as bank statements, payroll deductions, or written communication from the charity.

How much is the tax deduction for charitable donations

The actual amount deducted from your taxes depends on your total donation amount and your marginal tax rate. For instance, if a taxpayer in the 24% tax bracket donates $1,000, their tax savings would be $240 (24% of $1,000).

This reduces the out-of-pocket cost of their donation to $760, making it more financially feasible to support favored causes. This tax reduction acts as a fiscal incentive to encourage more frequent and larger donations by making it economically advantageous to give.

What percentage of charitable contributions are tax-deductible

Virtually all monetary donations to qualified nonprofit organizations are 100% tax-deductible up to the applicable AGI limits.

However, if a charity provides goods or services in exchange for a donation, only the portion of the donation that exceeds the fair market value of the benefits received is deductible.

For instance, if you attend a charity gala and pay $500 for a ticket but the fair market value of the dinner and entertainment is $200, only $300 of your ticket price would be deductible. Understanding these nuances can help donors effectively plan their charitable giving and ensure they maximize their tax deductions.

How Much Can You Claim Tax Deductions for Charitable Donations ?

The exact amount you can claim on your taxes for charitable donations varies based on several factors, including the nature of the donation and your financial circumstances. For cash donations, you can generally deduct up to 60% of your adjusted gross income (AGI).

However, if your donations include non-cash items, such as clothing, furniture, or stocks, the deductible amount is usually based on the fair market value of these items at the time they were donated.

Additionally, special rules might apply if you receive any goods or services in return for your contribution, which may reduce the deductible amount.

How much should I donate to charity for taxes?

Determining the optimal amount to donate for tax purposes involves balancing your charitable intentions with your financial capacity and tax situation.

It’s generally advisable to consult with a tax professional to understand how different donation amounts could affect your tax return, especially when making substantial donations.

For example, if you are close to a lower tax bracket threshold, increasing your donation could not only help your chosen charity but also reduce your tax bracket, yielding significant tax savings.

What Is the Minimum Donation Tax Deductions for Charitable Donations?

The minimum donation amount required to claim a tax deduction varies depending on the country and its tax regulations. Here’s a general overview of common requirements:

- United States: For cash donations to be deductible, you need a bank record or a written communication from the charity. For contributions under $250, a bank statement or receipt is generally sufficient. For contributions of $250 or more, a written acknowledgment from the charity is required.

- United Kingdom: There is no minimum donation amount, but you must be giving to an eligible charity and can maximize your giving through Gift Aid.

- Australia: Only donations of $2 or more are deductible, and they must be made to organizations endorsed as Deductible Gift Recipients (DGRs).

- Canada: There’s no specific minimum, but receipts should be provided for donations of $20 or more to claim them.

Each country or region has its own specific rules regarding the minimum amount and documentation required. Always check local regulations or consult a tax professional to confirm the rules for your jurisdiction.

Charity donation tax deduction limit

The charity donation tax deduction limit is an important aspect of tax planning for individuals looking to maximize their charitable impact while receiving tax benefits.

For cash donations, the deduction limit is usually 60% of the taxpayer’s adjusted gross income (AGI).

This means if your AGI is $50,000, you can deduct up to $30,000 in cash donations. For donations of assets like stocks or real estate, the limit is generally 30% of AGI.

Exceeding these limits may not be immediately beneficial as the excess can be carried forward for up to five subsequent tax years, allowing taxpayers to strategically plan their charitable contributions over a period of time.

What is the maximum tax deduction for donations ?

The maximum tax deduction for donations is structured to encourage generosity while limiting the potential for excessive tax avoidance.

For those who are particularly philanthropic, planning how and when to make donations—whether cash, stock, or property—can be crucial.

For example, in years when income is exceptionally high, increasing charitable contributions can be a beneficial strategy to reduce taxable income significantly.

Additionally, understanding specific rules for different types of donated assets is crucial, as items like artwork or vehicles might be subject to special appraisal requirements or deduction limits.

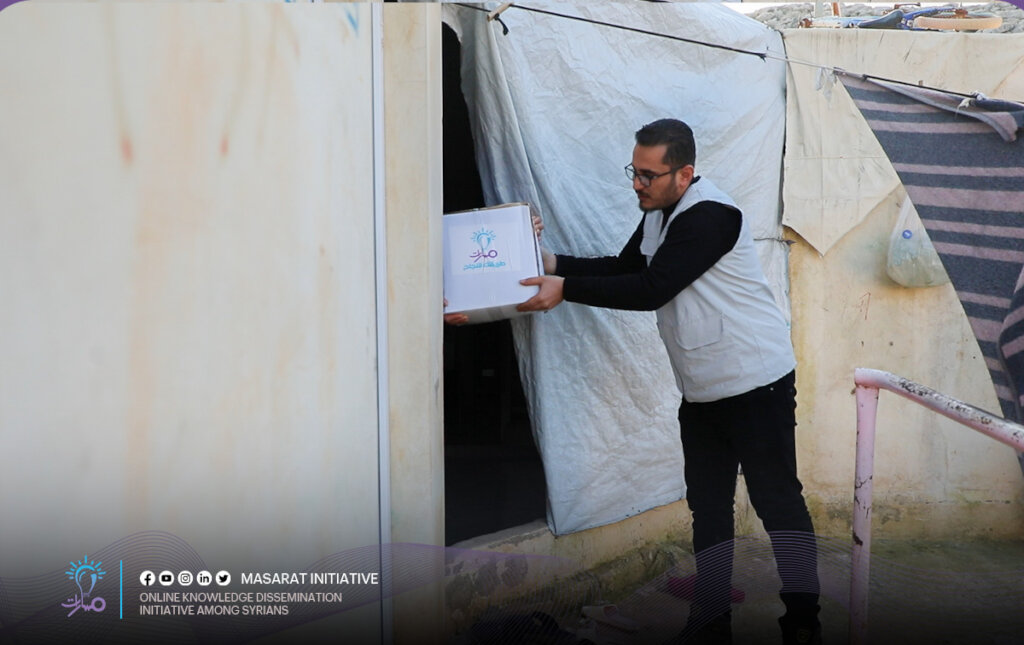

Masarat initiative Partner of Global Giving with 501(c)(3) Tax-Exempt Status

Masarat provides comprehensive educational services free of charge to Syrian students, particularly those most in need, such as orphans, the impoverished, and people with disabilities living in refugee camps. Through these free services, Masarat aims to empower individuals by equipping them with the tools needed to confidently enter the workforce.

Since its inception, Masarat has supported over 31,000 beneficiaries. It is a charitable organization partnering with Global Giving, which holds 501(c)(3) tax-exempt status in the United States and the United Kingdom.

You can support Masarat through donations and benefit from available tax deductions.A confirmation email will be sent to help with tax-related matter

We invite you to join us on this journey by supporting Masarat, whether through donations, offering expertise, or strategic partnerships.

Your contribution, no matter its size, makes a significant difference in the students’ lives and helps build a better future for them and their communities