In the realm of Islamic worship, Zakat stands as a fundamental pillar to achieve social justice and purify wealth. Zakat on non-worn gold is among the topics that evoke extensive discussion and jurisprudential research.

Today’s article provides a detailed overview of the rulings on Zakat for non-worn gold, outlining its conditions, Nisab (minimum amount for Zakat liability), and calculation method, based on the consensus and fatwas of the majority of jurists and scholars. Let’s delve into this exposition.

What is Non-Worn Gold?

Non-worn gold refers to gold held as an investment or savings asset, not used for adornment or clothing. This type of gold is considered part of one’s personal economy and is subject to Zakat in Islamic law under specific and precise criteria.

Ruling on Zakat for Saved Non-Worn Gold

Allah says: “And those who hoard gold and silver and spend it not in the way of Allah – give them tidings of a painful punishment.”

The term “hoard” refers to wealth on which Zakat is not paid.

Since non-worn gold is a saved asset capable of growth, it obligates the payment of Zakat if it reaches the Nisab threshold of 85 grams or more after one lunar year has passed.

Is Zakat Due on Non-Worn Gold?

The basis for Zakat on gold is intention: was it purchased for adornment or trade?

Meaning, gold worn for adornment is considered by the majority of scholars to be exempt from Zakat, despite some differences among jurists in their interpretations. Generally, it’s agreed that gold intended for a woman’s adornment is not subject to Zakat. Zakat is only required if the gold is saved, growing, or used for trade purposes.

Conditions for Zakat on Non-Worn Gold

You are only obligated to pay Zakat on non-worn gold if several conditions are met:

- Intention of owning it for wealth accumulation.

- A complete lunar year has passed since its acquisition.

- It reaches the Nisab, which is twenty Mithqal, equivalent to 85 grams of gold.

How Much is Zakat on Non-Worn Gold?

The amount of Zakat due on non-worn gold is “one-quarter of a tenth” of all the gold you possess. If you own 100 grams of gold, you must give away 2.5% of it as Zakat.

If you choose to pay Zakat in cash, calculate the total amount of gold and multiply it by the current market price per gram, then take out 2.5% of the total value. For example, for every 1000 Dinars, 25 Dinars should be given as Zakat.

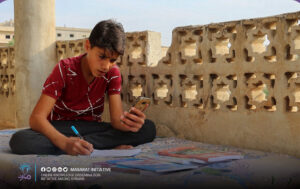

Masarat for Education and Sustainable Development in Northern Syria

Paying your Zakat to the Masarat initiative enables us to lend a helping hand to thousands of students dreaming of continuing their education.

Our initiative relies on financial donations to provide free support to these students, helping them complete their academic journey, paving the way for promising future opportunities.

In conclusion, Zakat is an obligation for believers to spend from their wealth in the way of Allah, purifying the soul. Through this article, we’ve presented the perspectives of jurists and scholars on the rulings of Zakat on non-worn gold and how to calculate it, enabling every Muslim to understand these rulings, apply them in their lives, stay connected to their faith, and achieve the pleasure of Allah Almighty.