Allah has imposed specific rulings for the obligation of zakat, as it is one of the most important acts of worship performed within very special legislations, in light of the Quran’s rules and the noble Sunnah. Therefore, great care must be taken in this regard. In addition to other articles on zakat and its key topics on Masarat’s blog, we discuss a new aspect related to zakat on saved money deposited in banks, highlighting its most important rulings and legislations.

Zakat on Saved Money in Banks

Islam mandates zakat on saved money when it reaches the nisab (minimum amount) set at 85 grams of gold.

If this money deposited in the bank reaches the nisab and a lunar year passes, zakat becomes obligatory on it annually.

Zakat Rate for Money Deposited in Banks

The zakat amount for money deposited in banks is a fixed rate of 2.5% of the total amount if it reaches the nisab and a lunar year has passed.

However, with varying amounts deposited by individuals, it is necessary to aggregate the money in the bank with other assets owned by the depositor to determine the correct zakat rate.

How to Calculate Zakat on Money Deposited in Banks

After the deposited money reaches the nisab of 85 grams and a lunar year has passed, its zakat is calculated at 2.5% of the total amount. If the payer owns other assets, these should be combined and then the zakat calculated.

For instance, if you deposit one hundred thousand dinars in the bank, the zakat on your money is calculated as follows:

100,000 x 2.5 ÷ 100 = 2,500 dinars (which is the obligatory zakat amount on you)

Is Zakat Due on Saved Money in Banks?

Yes, zakat is obligatory on money deposited in banks if the conditions of zakat are met, namely reaching the nisab and the passage of a lunar year on its possession. If it falls below the nisab, zakat is not obligatory.

Zakat Calculation on Bank Certificates

Zakat on money deposited in banks in the form of bank certificates is calculated at “2.5%” of the deposited money in the bank, provided that zakat is taken from the principal amount after a complete lunar year has passed on it.

Zakat on Borrowed Money from the Bank

Zakat is not obligatory on borrowed money unless it is free of interest gains.

Borrowing from usurious banks with interest is unanimously forbidden by the scholars of the nation and prohibited by the Quran and Sunnah. In this case, zakat is not obligatory on it.

However, if the borrowing is interest-free, and if the borrowed money reaches the nisab and a lunar year passes, zakat becomes obligatory on it.

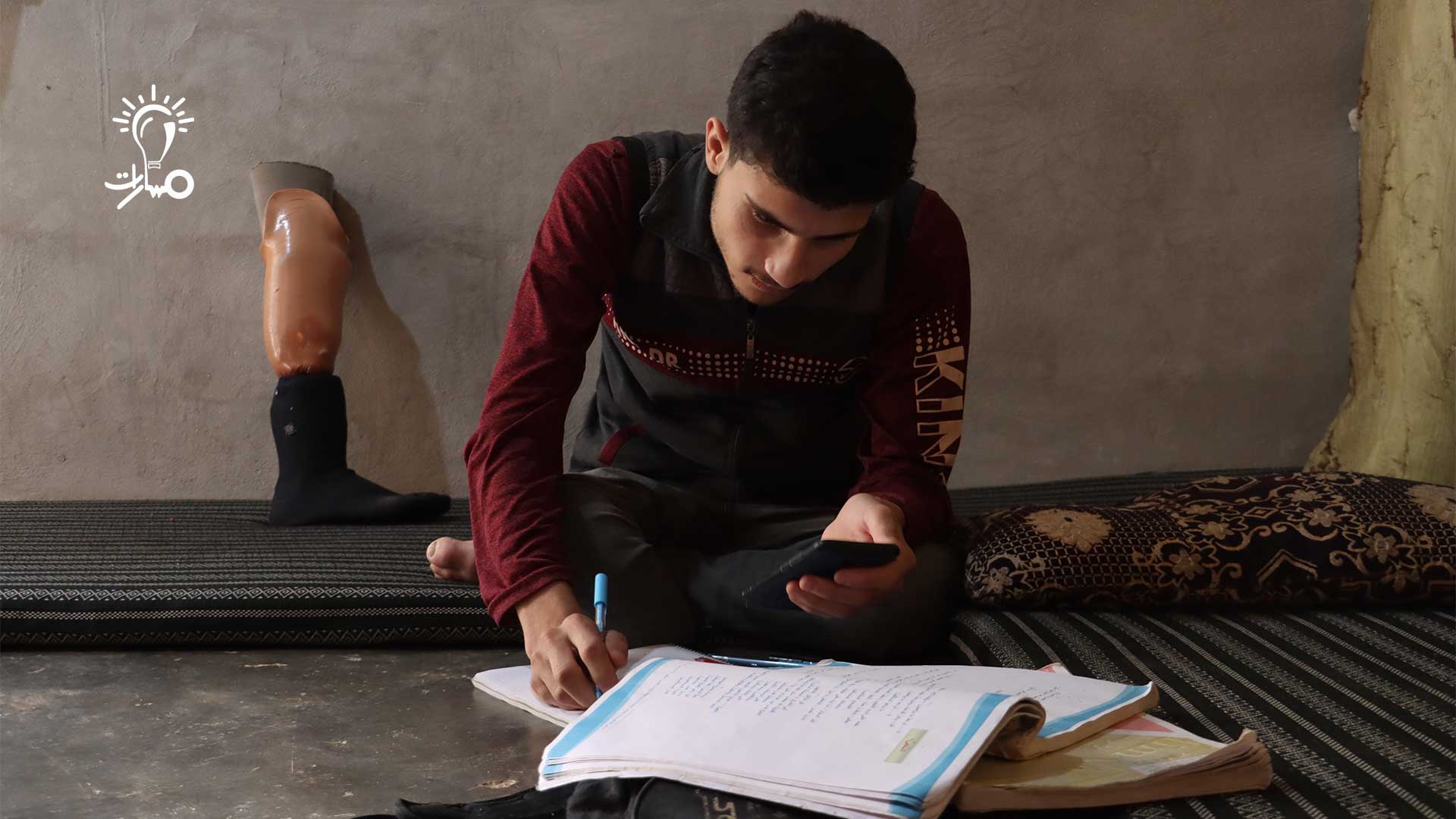

Masarat for Education and Knowledge Dissemination in Syria

Masarat is an initiative to disseminate knowledge online among Syrians affected by war and conflicts in Syria. We pay great attention to students seeking free education opportunities, contributing to the dissemination of knowledge and science through a sustainable knowledge endowment that offers scientific lessons on YouTube, in addition to various educational paths to support them in their learning journey.

There’s nothing better than allocating zakat funds to help a student of knowledge achieve their desire to reach the highest levels of knowledge.

The Masarat initiative cooperates with all its students to create a unique environment that encourages success and offers them educational and training pathways that enable them to lead scientific and practical lives.

Frequently Asked Questions About Zakat on Saved Money in Banks

The Ruling on Zakat for Money Deposited in the Bank for Living Expenses

Islam mandates zakat on money deposited in the bank for living expenses.

The principle of zakat is to be given at “one-quarter of a tenth”. However, similar to the zakat on land that yields rent and return for its owner, it is obligatory for the depositor to pay zakat on one-tenth of the profits from the money deposited in the bank without waiting for a full lunar year, only on the profits.

Zakat on Money Deposited in the Bank that is Periodically Increased

Zakat is obligatory on money that reaches the nisab and has completed a full lunar year of possession.

Thus, for money deposited in the bank to which new money is added periodically, zakat is obligatory as long as it reaches the nisab.

Do Banks Discharge Zakat on Their Funds So Zakat is Not Obligatory on Our Money?

If the deposit is in a legitimate investment account, the bank can pay zakat on behalf of the client with their permission, as gifts from partners are permissible. The deposited funds in banks fall into two scenarios:

- First: If deposited in Islamic banks, zakat is obligatory on both the principal and the profit.

- Second: If the funds are deposited in a usurious bank, zakat is obligatory on the principal amount only, and no zakat is due on usurious interest because it is illicit money, prohibited and not truly owned by the depositor. The principle of paying zakat on behalf of someone else requires their permission and knowledge, as the intention is fundamental in the obligation of zakat.

Sheikh Ibn Uthaymeen said: Anyone who discharges zakat on behalf of someone without being authorized does not fulfill the obligation on their behalf; because zakat requires intention, and it is not like repaying a debt.